Crypto’s Hidden Treasure: The NFT Project Everyone's Overlooking.

Very few are noticing the capital rotation about to flow into this project.

Many of you likely hold strong positions in crypto—hopefully in the top 4 performing tokens.

The next step? Maximising this opportunity by moving further down the risk curve into the best risk-adjusted NFT projects.

The one I cover in this blog has a significant shot. Once you see the data, it’ll make your decision much clearer.

Today’s newsletter was originally sent to paying members who support Carrot Lane for a small fee.

Annual members get a sizeable discount and a Zoom call with me.

Founding Membership? That’s the golden ticket to deeper insights I don’t share publicly—including all the benefits of the annual plan.

2021 was pure chaos.

People treated it like a digital land grab, trying to buy as many historically relevant NFT projects as possible.

I’m seeing a less intense version of that play out now but make no mistake—as the number of NFT collectors grows from 23 million last cycle to over 160+ million this cycle (based on the logarithmic trend of new participants), it will amplify the value of these earlier projects.

The beauty of historical NFTs lies in their built-in supply friction—no more can ever be created.

A small group of us bought into the thesis early: these "vintage" projects with an iron-clad supply would see demand grow over time, assuming you believed we’re becoming more digitalized—which, to me, is a no-brainer.

As more applications are built on blockchain rails, these historically significant projects will be considered fossils that preserve our civilisation for the next 1,000 years.

The more digital we become, the more we’ll value these digital assets.

Like with any early industry or asset, seeing the immediate value is hard. Instead, we saw people trading in and out of NFTs with a short-term, day-trading mindset.

One project I stumbled across on X (back when it was still called Twitter) was CryptoSkulls. I remember looking at the art and thinking:

“Huh, that’s pretty cool—feels like 8-bit Atari, Pac-Man, or Space Invaders.”

Growing up in South Africa during the arcade boom, that aesthetic hit home. The country was isolated from most of the world during apartheid, so many of our cultural influences came from the US—TV shows, restaurant chains, card collecting, and, of course, arcade culture.

During the NFT mania, I got into the habit of diving deep into projects and their Discords, reading every comment I could find. It became my own version of a community note system—a way to tap into the “wisdom of the crowd” and figure out what a project was really about.

It’s amazing how sharp your instincts get after sifting through 50+ comments. With CryptoSkulls, it quickly became apparent why people were collecting them—nostalgia.

That same sense of connection is precisely what drew me in.

The vibe in the CryptoSkulls Discord was a breath of fresh air. It wasn’t like the usual carnage of the time where everyone was obsessing over why the floor price wasn’t rising. This felt like a whole different world.

In the CryptoSkulls community, I found people who simply wanted to keep the art because they liked it.

I delayed buying one for some ridiculous reason—maybe it was the endless 10x to 20x opportunities flying around during the 2021 bull market.

The floor price was only 0.05 ETH, about the same as today's.

Looking back, it’s hard not to laugh (or cringe) at that decision.

About 5 or 6 weeks later, the CryptoPunks community flooded in, scooping up these tokens in droves.

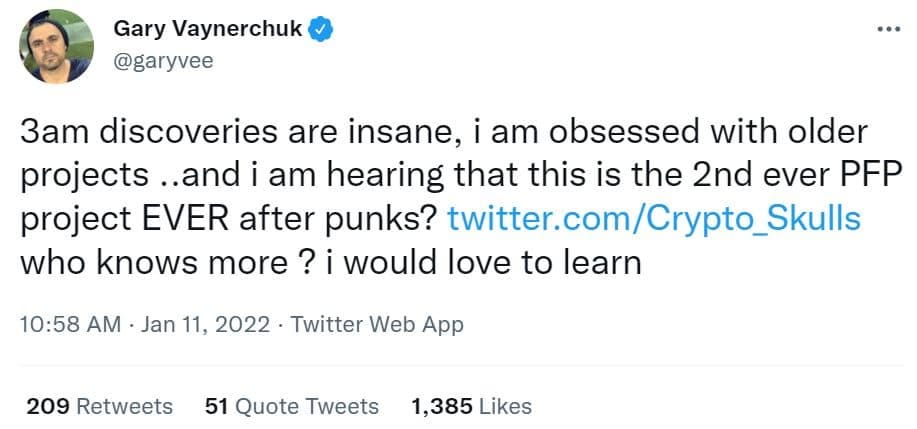

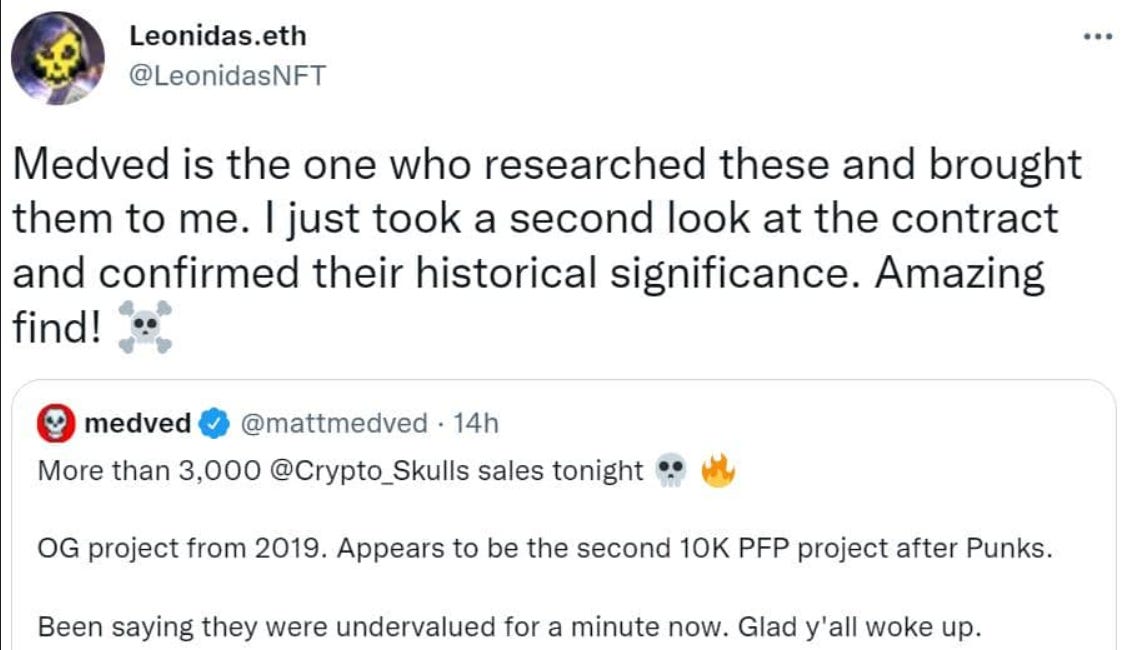

Big names like Steve Aoki, Matt Medved, Leonidas, Gary Vaynerchuk, Gmoney, and the legendary artist Fvckrender all bought in heavily.

By January 11th, CryptoSkulls had become the No. 1 trending NFT project, surpassing iconic collections like CryptoPunks.

The collection exploded, racking up over 5,000 ETH in trading volume on OpenSea and briefly hitting a floor price of over 3 ETH.

Gary Vaynerchuk bought the rarest piece in the collection and snagged multiple others, including Skull Lord #70 for 100 ETH (about $332,863).

It’s safe to say the experience rattled me—but I’ve learned to forgive myself quickly.

The beauty of crypto is that it always gives you a chance to play catch-up.

The Origins of CryptoSkulls.

CryptoSkulls launched in May 2019 as a nod to CryptoPunks, bringing its own dark, pixel-art style. Created by Alex Slayer, it was designed to be both collectable and culturally meaningful.

The collection includes 10,000 skulls, each with unique traits determining its rarity. Rather than adding flashy utilities, it focused on the basics—art and blockchain provenance. That simplicity still holds up today.

There are also 10 hand-drawn Skull Lords—legendary pieces with names and animations that stand out even now.

My advice? Jump into the Discord. Ask questions. Find art that speaks to you.

I don’t want this piece to sound like a Wikipedia entry on project rarities. I’d rather you dig in and come to your own conclusions.

If you’re optimising asset allocation, stick to one of two moves: buy the floor or go for rare tokens. Avoid the middle ground—unless you just love the art. In that case, buy what you like.

If you’re new to NFTs, do it to learn.

Everything is driven by liquidity.

During what can only be described as a bloodbath of an NFT winter, I’ve kept loading up on this project.

It’s one I’ll likely never trade out of.

As many of you know, I’m not overly attached to my crypto coins. I follow the best risk-adjusted plays based on how people rotate out of more significant assets into smaller, less liquid ones.

But my NFTs? That’s a different story. I’m much more attached to them—not just because of their value but for the social signalling and, let’s be honest, the status they bring within a like-minded community. That’s the real magic here, beyond the money.

This rotation happens in NFTs, too.

CryptoPunks, the first-ever 10k PFP project, works for the NFT market like Bitcoin does for crypto. When capital flows into Punks—the OG project—it often rotates into smaller, less liquid collections, which tend to see more significant percentage gains.

Punks act like a sentiment signal for the entire NFT space. When people are buying Punks, it’s like a bullish index for the market.

Currently, 184 Punk NFT holders also own CryptoSkulls.

I expect this number to climb even higher as the project gains traction.

If you look at the charts, the blue line shows OpenSea trading activity—the “eBay” of NFTs. What’s fascinating is that trading activity on OpenSea almost mirrors the trading volume of CryptoPunks (the black skyscrapers below).

Here’s the kicker: you can’t even buy CryptoPunks on OpenSea. So this isn’t direct Punk sales driving the activity—it’s pure market sentiment picking up with punks at the epicentre of it all.

When this happens, money starts rotating into other projects.

CryptoSkulls, being closely tied to Punks as the second-ever 10k PFP project, has a history of attracting Punk collectors but is also a far more reasonable entry for many here.

We are seeing overall NFT market sentiment start to pick up gradually.

Aggressive miss pricing.

I always tell people that their superpower as investors in this space is keeping it simple—or, as one reader put it, "first-principles thinking."

Don’t overcomplicate things or overthink them. Simplicity is your edge.

As of publishing, CryptoPunks has a floor price of 36 ETH (about $125k). For most, that’s not a great use of capital—unless you’re after the bragging rights of owning a Punk. In that case, go for it.

Using Punks as a global NFT index, it’s clear the bottom of the NFT market is in, and we’re now trending higher.

This is all driven by an uptick in global liquidity and people moving further down the risk curve, pushing these assets higher.

Or, as world-class Crypto researcher and liquidity expert Chris Burniske says:

$BTC's incredible strength sows seeds of doubt in alts, and those seeds of doubt are what create the next opportunity. Seen it happen repeatedly, with new reasons sprouting each time for why a rotation won't happen again -- and yet, just as Earth spins, we'll rotate.

The typical capital rotation—from Bitcoin to Ethereum, then into SOL and SUI, and eventually a wave of altcoins—also plays out in NFTs.

That’s why, in 2021/22, we saw nearly every project category rise together.

Historical projects moved up in unison. Female-led projects climbed in value when World of Women surged. The same happened with IP plays like VeeFriends and BAYC, and later with pure art collections. Even photography NFTs had their moment when the focus shifted there.

It’s human nature—we always rotate into the next big trade.

It’s something I watched unfold firsthand.

With the space set to grow by at least 7-10x, the same rotation mechanics will happen again—just on a much bigger scale.

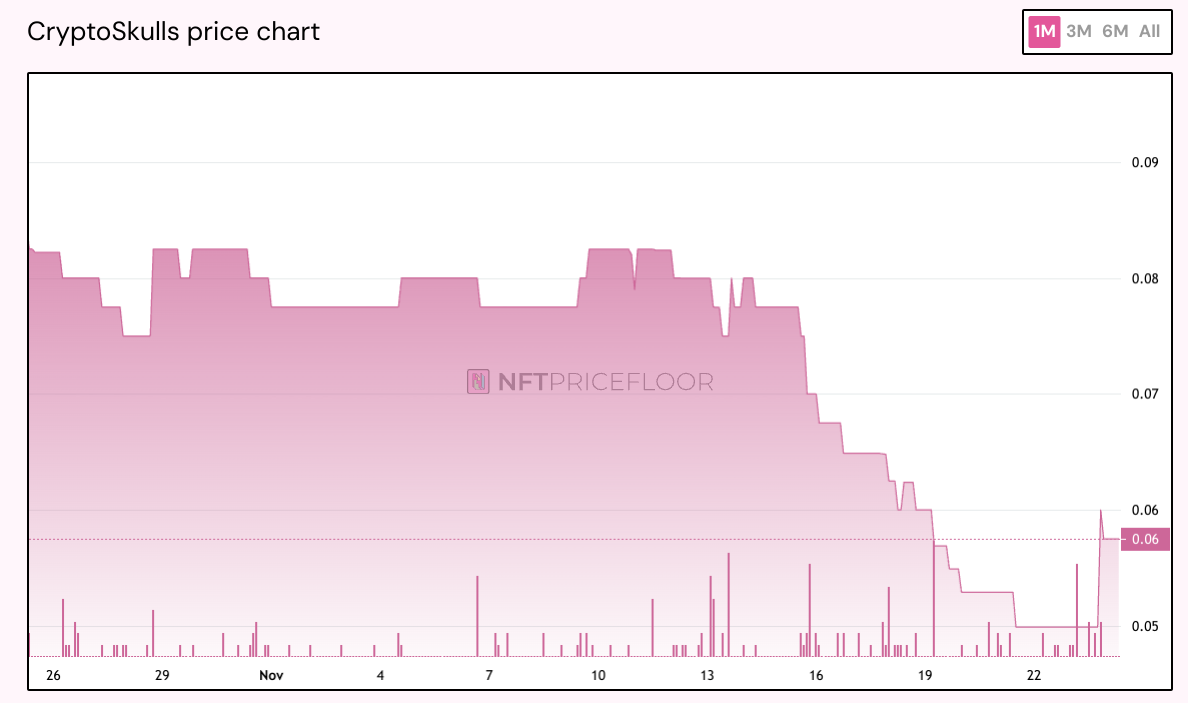

Right now, CryptoSkulls are at a ridiculously low floor price. Rising ETH prices are squeezing NFTs and driving values down.

But as Ethereum gets closer to, or even hits, all-time highs again—guess what? Humans being humans, they’ll rotate that capital.

And sitting right at the end of the risk curve are these trophy assets: NFTs.

Interestingly, we’re seeing some early signs of life in the Crypto Skulls market.

In the last 30 days, the ETH sales volume has risen by 82.4%, and unit sales volume has jumped by 117%.

Sentiment is shifting—you can spot the uptick on the chart.

Final Thoughts.

Chris Burniske once said:

“Just because something rotates, doesn't mean you need to chase it - if appropriately positioned, you can stand mostly still and enjoy the ride of the rotation. Counterintuitively, chasing rotation can leave you standing still...”

That’s why now is the time to start planting seeds.

I know this blog heavily emphasises price, which might contradict my advice about investing in projects you genuinely like.

But the data tells a bigger story—one rooted in owning a piece of history and, for many here, a rare chance to get in at ground level before the stampede arrives. I could only explain this by discussing the supply and demand elements.

I’ve intentionally skipped the nitty-gritty details about the project or its founder. Instead, my goal is to broaden your perspective and spark curiosity so you’ll dive in and do your own research.

The Crypto Skulls community is incredible. From what I’ve seen, they’re the most mature and welcoming.

While NFT technology helps organise communities, the people make all the difference.

So, join Discord, ask questions, and get to know the people there—you might make lifelong friends.

This is your head start.

Don’t blow it.

Find CryptoSkulls here.

PS—If you’ve found value in what you’ve read today, please consider sharing it with a family member or friend who could really use these insights—it helps our newsletter grow.