Crypto’s Next Move Is Already in Motion: It’s Being Led by One Overlooked Metric.

Most miss it. The ones who don’t, win big.

I came across a quote recently that really stuck with me — from none other than Elon Musk:

“The right metric for intelligence is probably the ability to predict the future. You're as intelligent as you can predict the future well. Because if somebody claims this person or this AI is very intelligent, how good are its predictions? If its predictions are not very good, it's not that smart. To predict the future, you have to think critically about the past and constantly try to be less wrong.”

He’s right.

What’s more useful than being able to see what’s coming? The ability to think critically about the past and adjust forward is, in many ways, the highest form of intelligence.

And when it comes to crypto investing, the most effective way to get your finger on the pulse and to understand what’s really going on in financial markets is to track one thing: Liquidity.

Not tariffs.

Not elections.

Not border policies or geopolitical drama.

Liquidity drives the system.

And if you follow it, you start to see what’s really moving markets. That means paying attention to financial conditions and understanding how liquidity is being added or drained.

Financial conditions lead asset prices by around 10 weeks. And right now? Every signal is flashing green — they’re improving fast.

But most people are missing it.

Before this recent relief rally, the general vibe on was doom. With assets down nearly 70%, my timeline was flooded with end-of-cycle takes.

Hate to break it to them — but they’re wrong.

The fun is just getting started.

Let’s dive in.

Liquidity is flooding the system — but almost no one’s noticing why.

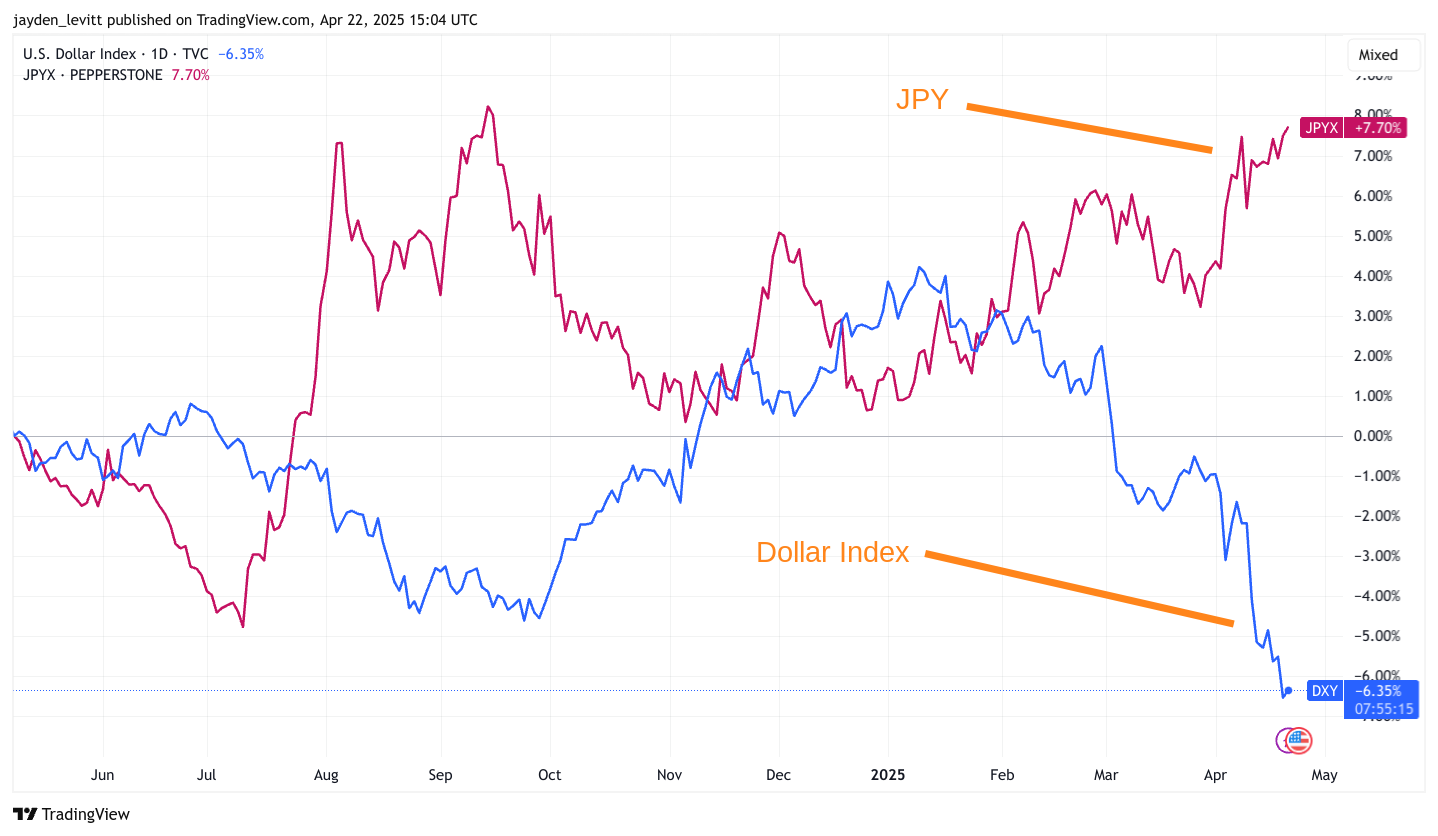

The DXY (Dollar Index) is in free fall, largely triggered by Japan’s recent sell-off of US Bonds.

They hold around $1.1 to $1.27 trillion in U.S. Treasuries — the largest foreign holder by far — so when they dump bonds the market feel it. Selling off dollar-backed Treasuries has boosted demand for the Yen and weakened the dollar in the process.

That’s a big deal.

Why? Because a weaker dollar is a tailwind for countries holding dollar-denominated debt, their repayments suddenly become a bit easier. It also helps boost U.S. exports by making American goods cheaper on the global market.

It’s not all positive.

Japan's economy relies heavily on exporting goods such as cars, electronics, and machinery. A stronger Yen means those goods become more expensive for foreign buyers.

For example: a $20,000 Toyota that cost 2 million Yen last month might now cost 2.2 million Yen to overseas buyers if the Yen strengthens.

That makes Japanese products less competitive globally, potentially reducing export volumes.

But it’s jolted them to the negotiating table:

President Trump posted:

“Japan is coming in today to negotiate Tariffs, the cost of military support, and “TRADE FAIRNESS.” I will attend the meeting, along with Treasury & Commerce Secretaries. Hopefully something can be worked out which is good (GREAT!) for Japan and the USA!”

Financial conditions tell a mixed story.

The MOVE index measures volatility in US bonds.

When it spikes, lenders become nervous and reduce the amount they are willing to lend against Treasury collateral.

Instead of lending the full value, they apply a larger “haircut,” or loan-to-value (LTV), which means less liquidity is created.

The liquidity maestro Michael Howell explains it perfectly:

“The MOVE index, a measure of bond volatility across the US Treasury curve, it does not only measure how much bond prices are shifting, it also determines liquidity creation via the size of the collateral haircut.

Consider, a dealer bank that wants to borrow against collateral using $10 million in Treasuries. If the credit provider sees a high and elevated MOVE index, it might only lend $9 million as it fears the $10 million in Treasuries could fall to $9.5 million in value.

The greater the bond volatility, the larger the haircut and the smaller the collateral multiplier.”

So, in simple terms, what he’s saying is—More bond volatility = bigger haircut = less money circulating in the system = our crypto doesn’t go up as much.

We all know that more money in the system results in ‘Number go up’!

However, bond volatility is currently high…

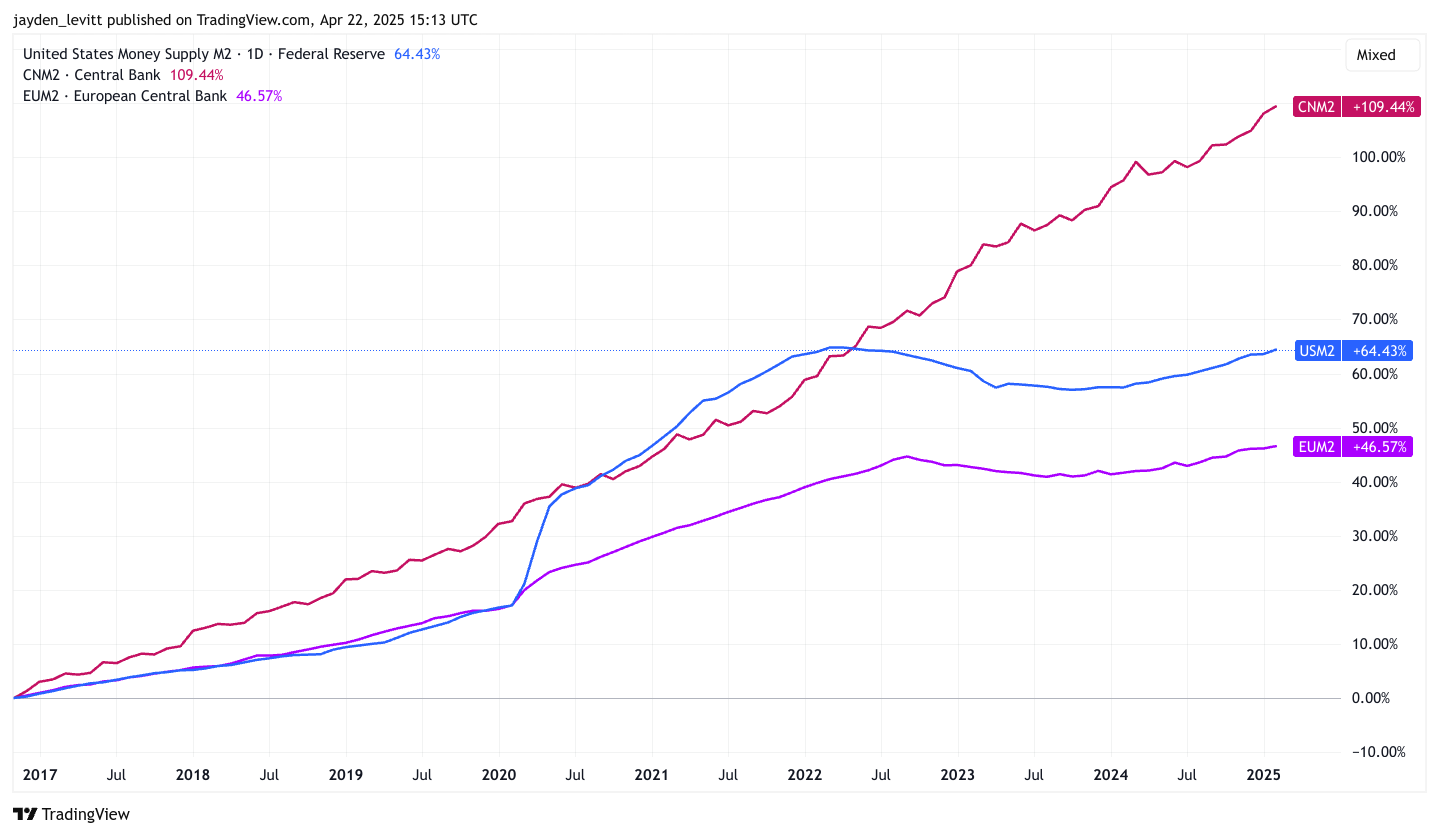

While the bond market is acting bipolar due to uncertainty surrounding tariffs, a weaker dollar is giving foreign countries the cover to print more money without destabilising their currencies.

Macro investing wizard Raoul Pal says:

Everyone needs and wants a weaker dollar to service their dollar debts. No one wants it to move too fast but they need it lower over next 12 months. This is the purest form of global liquidity and is the largest driver of global M2 currently. The US knows this too and is a key part of trade negotiations, especially with China.

As shown below, the M2 money supply for the USA, China, and Europe is at all-time highs, and all need to refinance and roll over old debt.

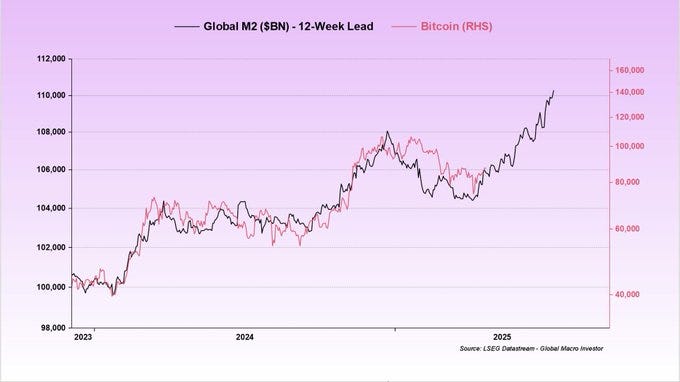

This Real Vision chart below is about as close to conclusive proof as you’ll get that liquidity is the dominant force in financial markets.

The relief rally we’re in is looking more and more like the start of a full-blown bull market, mainly because the dollar has been weakening, which has eased financial conditions across the board, and also because of the uptick in the money supply in the system.

The chart shows the M2 money supply with a 12-week lag behind Bitcoin, and the two lines essentially mirror each other.

So all the tariff talk...

Policy talk...

Even interest rates and the shaky bond market...

They’re background noise compared to global liquidity, and we’re seeing it play out clearly in asset prices.

But if you look closely, it also shows we go much higher from here.

The Big Six.

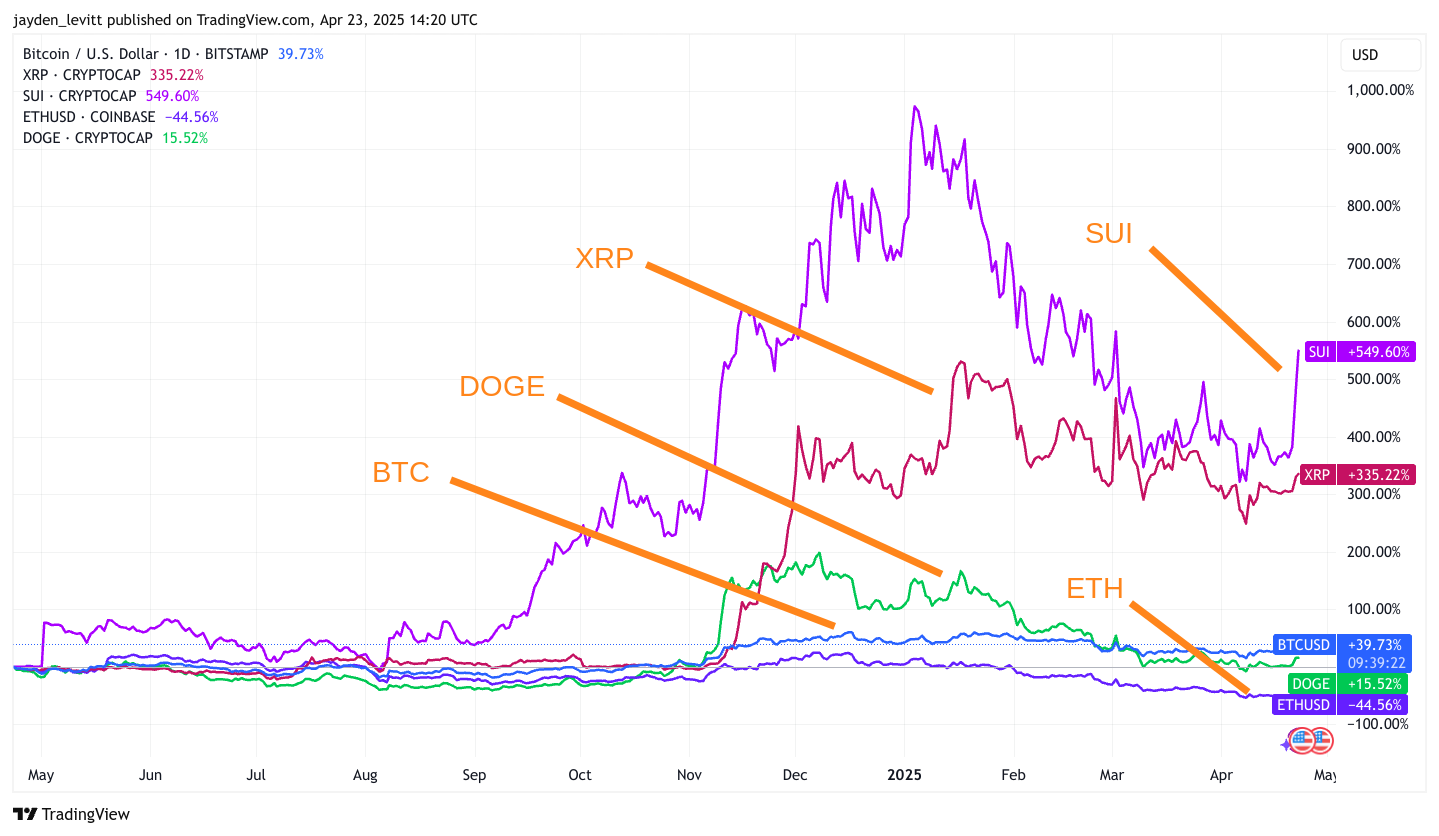

There’s nothing quite like seeing a clean hockey stick-shaped uptick on a chart.

It hits different.

If you bought the peak and held through two brutal months of tariff-fuelled chaos and you’re still standing, have a tilt of the cap on me.

That kind of volatility is the entry fee to crypto. But now, aside from just war wounds, you’ve got something most don’t: the right to say it wasn’t luck. You stayed when other shat themselves and panic sold.

I’ve said it before, price performance is the only source of truth. And right now, the outperformance in SUI speaks for itself.

It’s still my one and only crypto coin bet outside of NFTS.

Final Thoughts.

You don’t need to predict the future with precision. You just need to be a little less wrong than everyone else.

That’s what I reckon Unle Elon was really getting at. And in this market, that edge comes from understanding what actually moves prices.

Not Uncle Jerome.

Not media headlines.

Liquidity.

Most people miss it because they’re too busy reacting to surface-level drama, panicking like their investment’s about to vanish into thin air.

It’s not. Chill.

We’re all moving toward blockchain technology.

We’re all becoming more digital.

And the internet is not going anywhere.

If you got any value from this blog, consider sharing it with a friend or family member. It’s how I keep the lights on — and how Carrot Lane climbs the Substack leaderboard!

110%!!! The ones that panic sold, lost indeed. I'm so glad I bought more :)

Strap yourselves in, ladies and gentlemen - 2025-26 is going to be a glorious time.

Is it too late into SUI given the recent price spikes?