If You’re Investing in Gold and Not Bitcoin, You’re Messing Up (Mark Cuban)

The self-made Billionaire said, “you’re dumb as f***” if you invest in Gold. You’ll see why he thinks Gold is more of a religion than a sound investment.

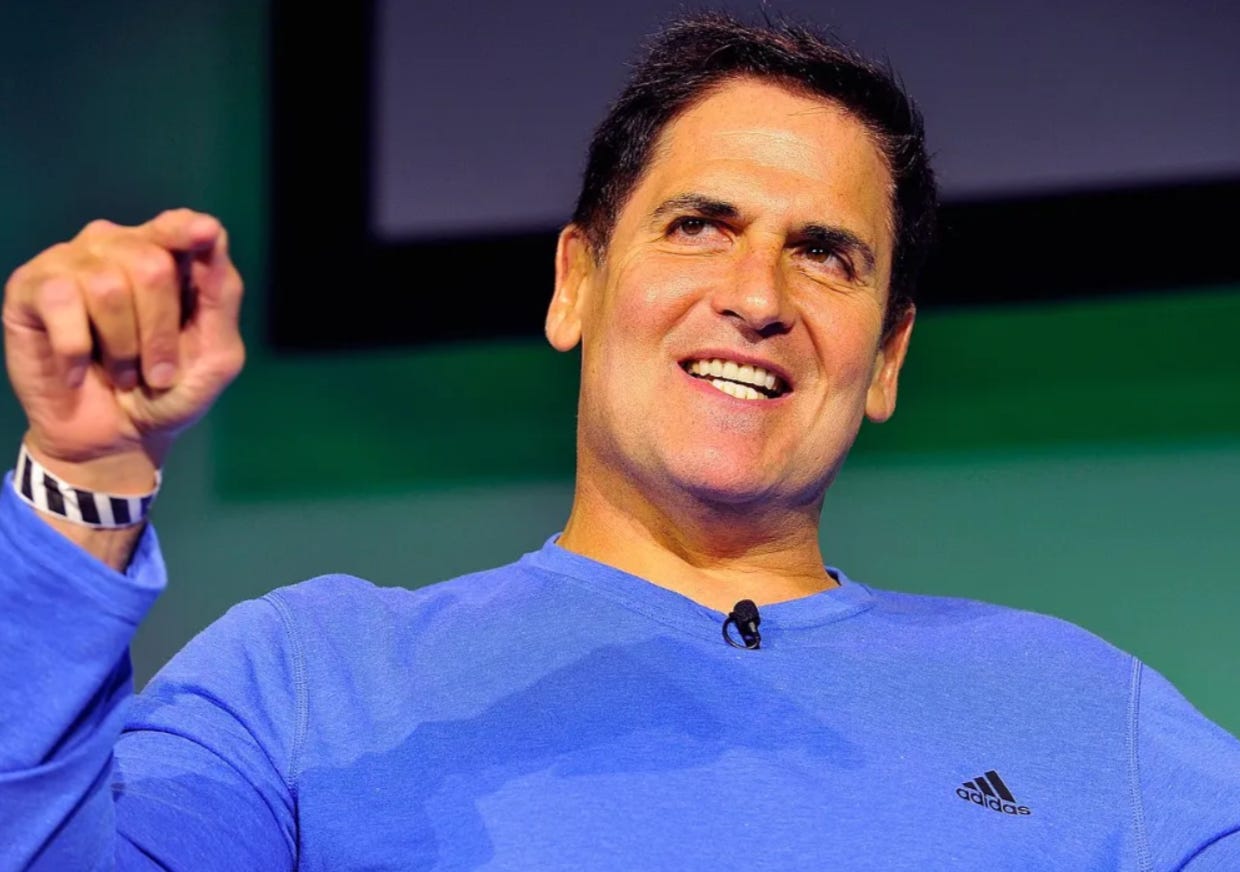

Source — Commons Image

Mark Cuban is a billionaire entrepreneur and owner of the Dallas Mavericks.

He’s known for his appearances on the reality TV show Shark Tank, where he and other investors consider offers from entrepreneurs seeking funding for their businesses.

He made his fortune through the successful streaming company Broadcast.com, which Yahoo purchased for $5.7 billion in 1999.

At the time, the acquisition was not well received and is now considered one of the worst purchases of an internet company in history.

Cuban made over a billion dollars by selling his Yahoo stock options just before the stock market crash of 1999.

The debate over a better store of value, Gold or Bitcoin, remains a topic among cryptocurrency enthusiasts and traditional investors.

While Gold has long been considered a reliable asset for preserving wealth, Bitcoin has gained popularity as a potential alternative due to its limited supply and decentralised nature.

Cuban, a huge proponent of Bitcoin, argues that it has the potential to be a more stable and secure store of value than Gold.

In a recent interview, Cuban jokingly said he’s “rooting against Bitcoin” and wants the price of Bitcoin to go down so he can buy more.

He then criticised those who own Gold, saying they’re “dumb as f***,”

Mark Cuban:

“If you have Gold, you’re dumb as f***.

Gold isn’t a hedge against anything.

It’s a stored value; you don’t own the physical Gold. Gold is a stored value, and so is bitcoin.

When you own Gold, all you own is a digital transaction. You don’t own the gold bar.

If everything went to hell in a handbasket and you had a gold bar, you know what would happen? Someone would beat the f*** out of you or kill you and take your gold bar”.

You’re Making a Huge Mistake Investing in Gold.

You may prefer Gold’s perceived stability and historical track record.

Ultimately, deciding which asset is a better store of value will depend on your beliefs and risk tolerance.

Cuban is a vocal supporter of Bitcoin and says while Bitcoin is not a physical asset backed by Gold or silver, it has value due to its utility and decentralised nature.

As a decentralised digital currency, governments or financial institutions can’t control Bitcoin, which makes it valuable for transactions.

He pointed to the limited supply of Bitcoin as a critical factor contributing to its value as a long-term investment.

Cuban’s enthusiasm for Bitcoin and his belief in its potential have made him a prominent figure in the cryptocurrency community and an influential voice in discussions about the future of digital currency.

He dislikes Gold, calling it a “religion” and a “collectable” rather than an investment.

And he compares Gold to Bitcoin, saying both rely on supply and demand but notes that only a finite supply of Bitcoin is available.

Unlike Gold.

Cuban does not view Gold as an alternative currency, saying you’d never see people in Puerto Rico carry large amounts of Gold.

He says Gold isn’t setting record highs, and people need to use it as a store of value in the way they have historically.

Cuban has a negative view of Gold and believes it’s a poor investment compared to Bitcoin.

Mark Cuban:

“I hate Gold.

I see Gold and Bitcoin as being the same thing.

The value is based on supply and demand.

The good news about Bitcoin is there’s a finite supply that will ever be created, and the bad news about Gold is they’ll keep on mining more.

I do not see it [Gold] as an alternative to currency.

It’s fine to try to save things, but I think it’s more of a religion than an investable asset.”

Final Thoughts

It’s clear Mark Cuban is a Bitcoin Bull.

He strongly advocates for Bitcoin as a store of value and investment opportunity.

He believes Bitcoin’s algorithmic scarcity and limited supply make it a more attractive option than Gold, which he views as a “religion” and a “collectable” rather than a sound investment.

Cuban also sees Bitcoin as having a significant advantage over other blockchains due to its lack of competition as a store of value.

As other blockchains fail, Bitcoin is a safer and more conservative choice for investors looking to store their wealth.

Not everyone shares Cuban’s optimistic view of Bitcoin.

Some critics argue that the highly volatile nature of Bitcoin makes it a risky investment and that the lack of regulatory oversight and trust in custody partners like exchanges going into liquidation makes it an unreliable store of value.

It’s worth considering both sides of the argument before making investment decisions.