Kevin O’Leary: If You Understand Modern Portfolio Theory, You’ll Become Wealthy

The markets will treat you so much better using this method.

Photo By Adam Jeffrey on Flikr

Occasionally, a little luck and a helping hand can make all the difference.

Kevin O’Leary’s mother was a skilful investor.

Throughout her lifetime, she kept her investments a secret.

Georgette Bookalam managed her finances with care and foresight. She shared her financial wisdom with Kevin and planted the seeds of curiosity and ambition in him.

Her meticulous approach to managing money left a lasting impression on Kevin, who admired her financial skill and would later adopt a similar investment philosophy.

O’Leary now has an estimated net worth of $400 Million and has been featured on the U.S. hit programme Shark Tank for over ten years.

It’s easy to see why.

He has an uncomplicated communication method if you’ve ever heard him speak. He describes complex subjects and breaks them down in simple-to-understand language.

O’Leary’s tongue-in-cheek nickname, “Mr Wonderful”, refers to his reputation for being mean and reflects his blunt assessments of misguided entrepreneurs on Shark Tank.

He’s a pro at speaking his mind spontaneously and dishing out some sass.

Lately, he’s faced criticism for his insensitive remarks on business and finance, shared via his Twitter account.

Many criticised O’Leary’s message for promoting traditional masculine stereotypes and suggesting that success should be prioritised over emotional and social connections, often considered “feminine” traits.

Kevin O’Leary — Source

“You may lose your wife, you may lose your dog, your mother may hate you.

None of those things matter. What matters is that you achieve success and become free. Then you can do whatever you like.”

Modern Portfolio Theory

American economist Harry Markowitz developed Modern Portfolio Theory (MPT) in 1952.

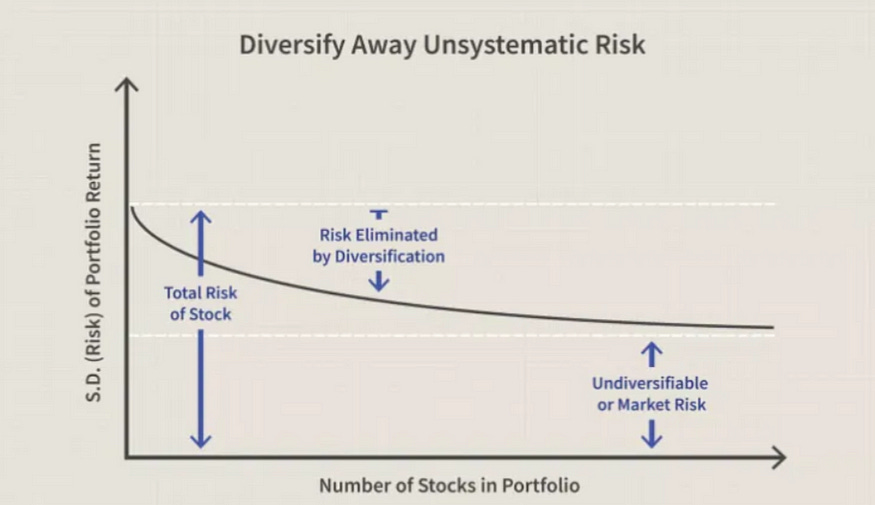

The main idea is to spread your money across different investments (diversification) so that if one investment doesn’t do well, others might still perform well, reducing your overall risk.

In simple terms, MPT is like not putting all your eggs in one basket, so you can better manage the ups and downs of the financial market.

Markowitz realised that you, as an investor, should focus on more than just the potential returns of individual investments. Instead, it would help if you also considered how these investments work together in your portfolio.

Through his research, he found that you could create a more competent portfolio by mixing different investments with various levels of risk and return.

This portfolio would either maximise returns for a certain level of risk or minimise risk for a certain level of returns.

The breakthrough idea laid the groundwork for Modern Portfolio Theory and led to Markowitz winning a Nobel Prize in Economics in 1990.

According to O’Leary, 99% of Wealth Funds Use This Approach.

O’Leary believes you should adopt the same stance as 99% of Sovereign Wealth Funds, embracing the Modern Portfolio Theory regarding your investments.

He says most investments are either high risk and high return. Or low risk and low return.

O’Leary says investors could achieve their best results by choosing an optimal mix of the two. He says MPT helps risk-averse investors construct diversified portfolios and is a practical way of selecting investments to maximise overall returns within your risk tolerance.

Kevin O’Leary uses this method for his stock investments and says that when it comes to your portfolio, you should treat your investment the same.

Invest at most 20% in one sector.

Never Invest more than 5% in a single stock or bond (or Crypto)

Kevin O’Leary—Source

“A major lesson I learned from my mother that really worked for me over the years. She had a basic portfolio theory of diversification.

In her day, there were only ten sectors in the S&P; today, there are 11, including the new one — real estate.

So, you never put more than 20% in any one sector and never more than 5% in any one stock.

That forces you to get diversified, and the market treats you better when you’re diversified because you never know what’s going to happen.

I’m a diversified guy; I never have more than 5%. If a stock does become more than 5%, like my Tesla stock did, I simply sell it down to 5%. If it keeps going up, I keep selling it down, so I’m taking cash.”

The fundamental chart below shows that as the number of stocks in your portfolio increases and diversifies, your risk starts to be eliminated.

Not Everyone’s On Board

Warren Buffett, one of the most successful investors, has an interesting perspective on MPT.

Alongside his long-time business partner Charlie Munger, they say MPT has led to a misguided direction in investment education over the past four decades.

When you buy a business, you own a business.

As a result, you need to focus on the right aspects of investing. Buffet and Munger believe the problem with all these theories is people are fixated on the numbers and data, losing sight of the bigger picture.

According to Buffett, volatility isn’t an accurate indicator of risk.

He points out that an investment with fluctuating returns between 20% and 80% isn’t necessarily riskier than one that consistently earns 5% annually. Instead, Buffett defines risk as “the possibility of harm or injury.”

They stress the significance of knowing the core aspects of a business instead of solely focusing on graphs and numbers. Munger playfully describes their method as “enlightened common sense.”

Warren Buffett — Source

“Much of what is taught in modern corporate finance courses is twaddle.

Modern portfolio theory has no utility.

It will tell you how to do average, but I think anybody can figure out how to do average in fifth grade.

It’s elaborate, and there are many little Greek letters and all kinds of things to make you feel that you’re in the big leagues, but no value is added.

If you find three wonderful businesses in your life, you’ll get very rich.

And if you understand them, bad things aren’t going to happen to those three.”

Final Thoughts.

It is positive to acknowledge different perspectives on investing and portfolio management.

The diversification part of Kevin O’Leary’s argument is correct, but I believe Buffett is right.

It doesn’t prevent risk.

You can invest in different sectors, but those companies can still be risky investments.

O’Leary’s mother’s guidance and financial insight were crucial in shaping his investment philosophy and success.

Ultimately, deciding which approach best aligns with your goals and risk tolerance is up to you.

Warren Buffett and Charlie Munger take a more fundamental approach.

Like, “is it a good business you’re investing in?”

If you’re not sure, maybe that’s the risky part.