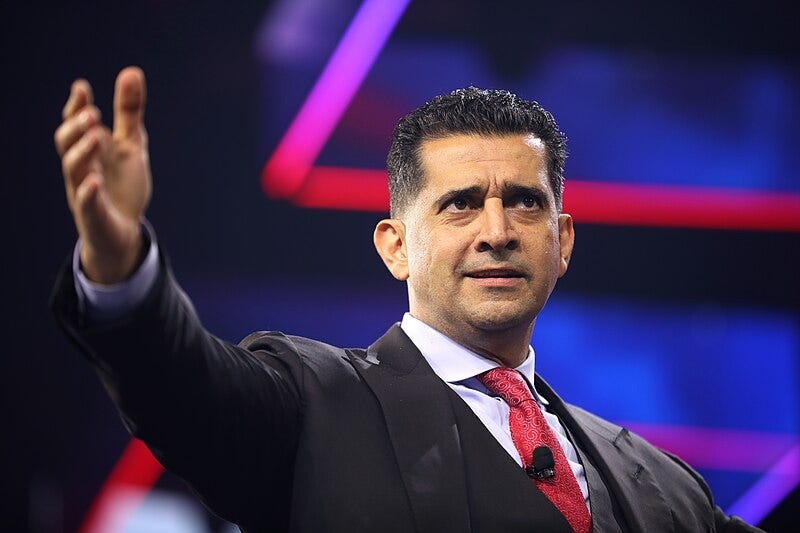

Patrick Bet-David Reveals: The ‘Reverse Market Crash’ No One Is Discussing.

The world-renowned businessman says there’s an even worse scenario than the stock market collapsing.

The rich will get richer, and the poor will get poorer, but the divide will be on steroids this time.

Patrick Bet-David’s hallmark is coming from the dirt and triumphing through adversity — you can sprinkle in some self-made luck.

At ten, he escaped Iran for a German refugee camp to avoid the revolution where civilians were getting publicly executed.

For most people, it’s an unrelatable hurdle, but Patrick says the experience shaped his core belief because when he left, he found refugees were all escaping for the same reason.

Patrick Bet-David — “The most valuable thing that we wanted and were willing to sacrifice everything — to go to a different country where we didn’t speak the language and then come to America was for one word, and it starts with the letter “f”, and it’s called “freedom.”

PDB first landed on my radar eight years ago through a video that melted the internet.

The 90-second clip took me and 25 million other viewers on a journey, and I’ve been immersed in his no-nonsense message ever since.

I remember watching the video at a time when entrepreneurship and Silicon Valley founders were on a pedestal. In the clip, he wipes away the fluff and shows what sacrifices look like.

With few followers, zero marketing, and no boost or paid promotion, the viral hit depicted PDB’s struggle through entrepreneurship.

It shows Patrick knocking on doors, getting rejected, having no money, the stress of people deceiving him, and then a final fed-up scene of him slumped over the steering wheel of his banged-out Ford Focus.

PDB's estimated net worth is $200 million today, and his insurance firm has grown to 17,000 people and 150 offices.

In a video, which is also going viral, the man who speaks about the economy and modern finance now says there’ll be an even worse scenario than the prospect of a stock market collapse.

It’s a phrase he coined as a“reverse market crash”.

Buckle up, and let’s dive in.

House prices are climbing, but here’s why it’s not what you think.

The Federal Reserve, trying to tackle the rising cost of living, has increased interest rates to a 22-year high of 5.5%. Wild.

It’s left people with eye-watering mortgage payments for those who didn’t secure lower interest rates.

But here’s the bizarre twist.

House prices have increased in the U.S. primarily because of the lack of people wanting to sell.

The average home sale price, as reported, currently stands at $430,300. It’s an increase of $14,200 (3%) from the previous quarter, even after a correction.

For a cost of living crisis, something is starting to smell fishy.

PDB says Fed chair Jerome Powell can not, under any circumstances, succumb to election pressure to reduce interest rates because it would result in the “Rich and Poor divide but on steroids.”

We’re seeing the Fed address inflation with its only tool, interest rate hikes, which are working: It’s down from 8.2% to 3.4%.

But the consumer economy is still doing well, with unemployment at 3.9%, the lowest it’s been since the 1970s.

Patrick says these are perfect conditions for a “reverse market crash”, and it’s something hardly anyone is talking about.

Patrick Bet-David — Source

“A reverse market crash, you know what’s gonna happen? What would happen if Jerome Powell decreased rates to 5%, 4%, or 3%? Do you know what would happen today? You think that house that’s $900,000 that the value hasn’t moved even when they (banks) raised the rates to 8%, that $900,000 house will be $1.4 million. And if the DOW Jones suddenly goes to 48,000, you know what would happen? This whole concept of Rich getting rich or poor getting poor, it became Rich getting rich or poor getting poor on steroids.”

The one move governments can make will surprise you.

The answer is to print more money to service debt.

In his quarterly report, Jamie Dimon, Billionaire chairman of JP Morgan Chase, says, “It’s the most dangerous time the world has seen in decades”.

Ray Dalio, one of the most outstanding hedge fund managers ever, says,

“You can’t keep spending money and expect inflation to come down because when you restimulate, asset prices go back up again”.

Governments have debt likely to keep growing because it’ll cost more to pay off the existing debt with high interest rates.

As debt keeps rising, Dalio says:

“Governments will need to sell more debt, so there will be a self-reinforcing debt spiral that will lead to Market-imposed debt limits. Central banks will be forced to print more money and buy more debt as they experience losses and deteriorating balance sheets.”

As the deficit compounds, central banks may have to print more money and buy more debt (government bonds), which will increase the money supply and cause asset prices to rise.

Because new money is inflationary and stimulative, people who own financial and physical assets will win the most.

The lowest earners and bottom tier of society will bleed the most from the cost of living.

What could a worst-case scenario actually look like?

Patrick Bet-David says income inequality has led to people fleeing Venezuela.

The yearly inflation rate, which dropped from 686% in 2021 to 234% in 2022, is now back up to 395%. The cost of living is crushing them.

To put it into context, U.S. inflation is 3.4%. PDB says America could suffer the same fate, provided Powell doesn’t succumb to election pressure to reduce rates and restimulate.

He thinks we must be in this high-interest rate climate for a “few years”.

When the money printer purred like a well-oiled machine, the Federal Reserve printed approximately $3.3 trillion in 2020 alone. That’s one-fifth of all U.S. dollars in circulation in the same year.

A recent survey revealed the number of those living in poverty in Venezuela had fallen from 65.2% to 50.5% in 2022, but income inequality had continued to widen.

The poorest 10% in Venezuela survive on just $8 a month, compared to $553 for the wealthiest 10%. Since 2015, more than 7 million (25%) of Venezuela's 28 million population have fled their country.

When you see how the Venezuela stock market is performing relative to the people trying to survive and the mass exodus, it highlights how wide the “rich and poor” gap is getting.

Final Thoughts.

It’s not all doom and gloom.

The thread of hope comes from the Fed chair, who thinks his outlook for the economy is that there won’t be a recession.

Jerome Powell — Source

“So the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the economy’s resilience recently, they are no longer forecasting a recession.”

I’m not so convinced.

It doesn’t solve the problem for the 80% of Americans who live paycheck to paycheck.

Credit card debt is skyrocketing, and savings rates are dropping faster than a broken elevator.

As for publishing, people saved 3.2% of their disposable income, the lowest on record, much lower than the usual long-term average of around 8.9%.

Credit card balances total over $1.115 trillion, the highest they’ve ever been in U.S. history and up 30% since January 2021.

PBD says the price of everything will become an obstacle for people and an even more significant hurdle for those with consumer debt like credit cards.

As he says — “We think the economy is doing well, but it’s a lie because the top 1% are crushing it while everyone else is getting destroyed”.

It’s a point I agree with.