SUI Is Still My Top Crypto Bet—And Most People Are Missing Why.

Amid macro mayhem the Crypto bottom might be in...

I’ve made todays newsletter free for all subscribers, but it was origainlly sent to paying members who support with a small fee who make it possible (love you guys).

If you're looking for more value, our annual plan is your best bet—it saves you over 50% for the year and includes a free one-on-one call with me.

For those who really want in, our Founding Plan takes it a step further. You get an hour-long one-on-one call, plus monthly group calls and daily access to our private group for insights I won’t share publicly.

Upgrade to ensure you're getting the most out of your subscription and staying ahead of the curve.

Crypto markets have been dropping faster than a broken elevator.

As a writer, I can usually gauge sentiment just by checking my inbox—lately, it’s been full of people in panic mode. And I get it. Watching a significant drawdown like this unfold is a gut punch.

But if you’ll lend me your ear for a moment, I’ll explain why I’ve been throwing every last bit of spare cash into SUI like my life depends on it.

The first hit to asset prices came from DeepSeek AI, wiping nearly a trillion off tech stocks and dragging crypto down with it. But the bigger story is Donald Trump and his bombastic—yet undeniably effective—negotiating tactics around tariffs.

I wrote an entire piece, breaking it down: Click here if you need to catch up.

But to sum it up, I’ll defer to the Jerry Springer of politics and longtime Trump ally Piers Morgan, who recently had this to say…

“I’ve known Trump a long time and one of his favoured techniques is to say something that sounds outrageous, shocking and extreme to jolt people to a negotiating table, I’ve seen him do it many times.”

Piers is right.

Something is happening behind the scenes that few are paying attention to—China’s hands are tied.

They can’t print more money to boost their economy because of the strong dollar, which is the liquidity provision for the entire system. Trump knows this. So, while he’s out in the media calling for Jerome Powell to cut rates, keeping them high while he negotiates a trade deal actually benefits him.

U.S. goods and services become more expensive for foreign buyers when the dollar is strong. This slows U.S. exports and hurts businesses that rely on international sales. At the same time, cheaper imports might sound great for U.S. consumers, but they undercut local businesses that now have to compete with foreign goods.

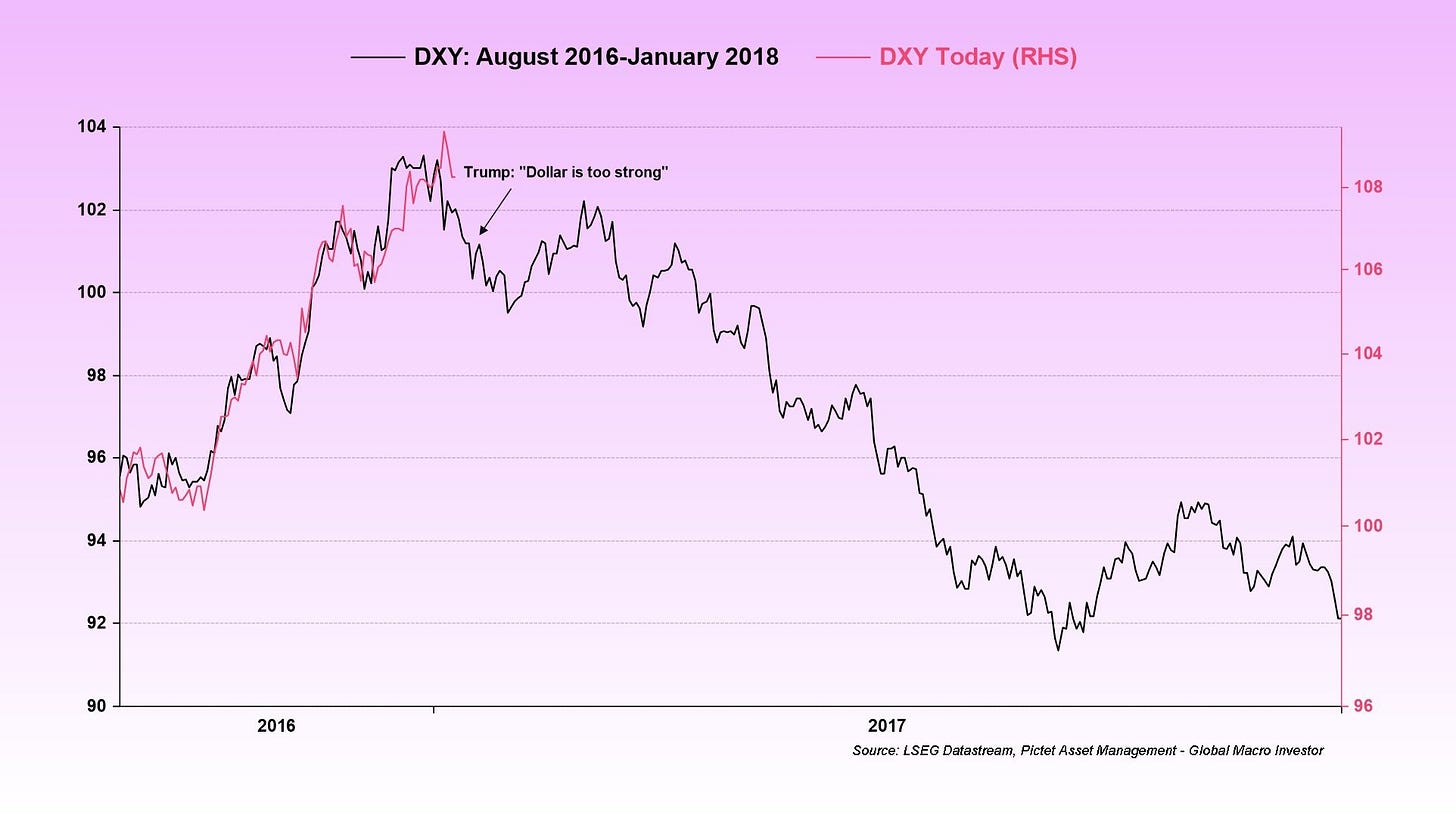

Everyone—China, the U.S., and global markets—needs a weaker dollar. Business cycle expert Julien Bittel points out that Trump pulled the same move in 2017.

Back then, the dollar was strong, and shortly after taking office—once higher tariffs were locked in—he started saying, “The dollar is too strong.”

Julien Bittel: “Trump understands the impact of a strong dollar — and the same logic applies to high interest rates. They suppress exports, hurt corporate earnings, and slow economic growth. What happened next? Well, the dollar began a significant decline, setting the stage for one of the most pivotal macro moves we’ve seen in years.

Indicators very few will notice (but must).

Bitcoin is the most sensitive asset to global liquidity.

It tracks the global money supply by about 98% with a 12-week lead time. As we all know, Bitcoin acts as an index—a sentiment signal for the entire crypto market—so global liquidity is absolutely key to whatever Crypto asset you hold.

Watching how policy moves drive liquidity gives you a clearer idea of where asset prices are headed.

This week, world-renowned liquidity expert Michael Howell had an interesting conversation on The Informationist. In short, he explained that the Fed is running out of money, and the funds Jerome Powell is holding are "barely adequate."

His co-host, former hedge fund manager James Lavish, even suggested that Powell "flat out lied" when he claimed the reserves were ample.

"He (Jerome Powell) starts getting nervous when bank reserves reach about ten percent of GDP, which is exactly where we are now—with roughly $3.2 trillion in reserves. We're at the ten percent mark because we still have about $600 billion left between the reverse repo and the Treasury General Account from the initial drawdown. At this point, the scale of QT is almost insignificant."

So Uncle Jerome’s math ain’t mathing.

The reverse repo is down to its last $76 billion, and the Treasury General Account holds only $817 billion.

With a monthly burn rate of $580 billion and so-called "ample cash reserves" of $3.2 trillion, the US—the world's second-largest economy—could keep things running for only about 6 months before defaulting.

Michael Howell says the Fed’s strong dollar policy might be deliberate in the hope of trying to secure a better trade deal with China before introducing quantitative easing (money printing).

“The problem in the near term is that China is struggling to inject liquidity—if it injects too much, the Yuan will collapse against a strong dollar. You can debate whether the dollar is deliberately being pushed up as a negotiating tactic—I believe it is.

The Fed isn’t being generous. It's lagging behind and hasn’t indicated when it will shift from QT to QE, even though it desperately needs to.

Perhaps they're playing a game: pushing the dollar up to hold China's feet to the fire so the US can secure a much better deal later in the year. That may be what's going on."

Here’s why I’ve still been buying SUI.

So, the macro picture hasn’t changed.

It’s increasingly likely that the Fed will pivot to QE very soon—so I, regardless of price capitulation, have been adding to my SUI position.

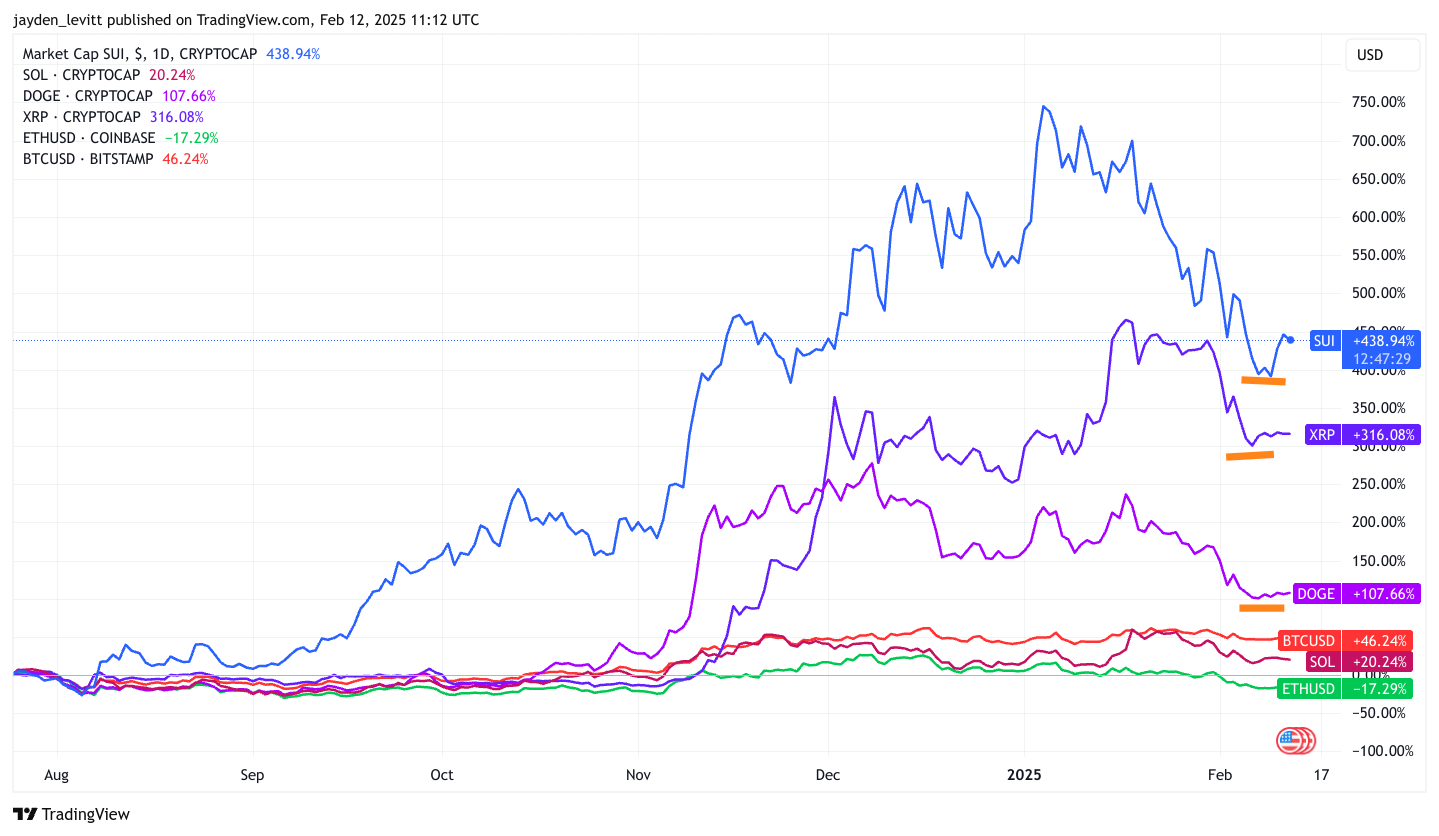

I know readers here will have exposure to other assets, hopefully—Bitcoin, XRP, DOGE, ETH, and/or Solana — which are great assets, but I am fully allocated to SUI for reasons I explain here: Why I’ve Swapped All My Crypto Into SUI

Now that we've seen a recovery after Trump's tariff price pressure, any positive news from trade deal meetings is likely to boost prices further.

I'm adding to my core position and treating this as an accumulation phase.

Sure, there might be more corrections down the line, but with support holding around the $9 billion mark, it feels like the right time to add.

Likewise, the same logic applies to all of the top 6 assets.

The anticipated liquidity squeeze from tariffs is now priced in, so any positive news from these negotiations should push prices higher. SUI remains my core position because, although it experiences larger drawdowns, its upside potential is much greater—and we can already see that from the recovery.

One factor that isn’t discussed enough is that its market cap is only $10 billion, compared to over $100 billion for the other top 5 assets (except DOGE). This means it takes much less buying pressure to drive its price up.

As this blog emphasises, increased money in the system drives asset prices higher, starting with Bitcoin. However, as financial conditions improve, people rotate further into other coins.

So, my bet is on SUI to continue the trend of outperformance as more retail folks join.

Final Thoughts.

Crypto’s been dropping like crazy, but that’s precisely where the opportunity is.

I've been using the last of my cash to invest in SUI because all the macro drama—Trump’s tariff moves, the Fed's tightening, and China’s liquidity struggles—is setting the stage for a rebound.

You can almost feel as dirty as a muddy puddle putting money into something that seemingly keeps dropping, but the overall story hasn’t changed one bit.

The US and China are running out of money. China needs to refinance $20 trillion, and the US need to roll over $7 trillion.

It just becomes obvious that the expansion of the money supply means there is more money in the system chasing these Crypto assets because people have more in their pockets for discretionary spending.

I block my ears and keep buying my highest conviction asset.

It’s an obvious reason, but very few can see it.

If this blog brought you any value, please consider sharing it with a friend; it’s how our newsletter, Carrot Lane, grows.

Really enjoyed this article this morning! Thank you, Jayden!