The Hard Truths About Crypto Investing I Wish I’d Known Sooner.

A simple framework that would have saved me heaps of head aches.

Big thanks to all the amazing subscribers who make this newsletter possible with their support! If you haven’t upgraded yet, now’s the perfect time—your support helps us keep growing and delivering even better content.

And hey, if I don’t catch you before then, have an absolutely fantastic Christmas! 🎄🎁

I've left an ungodly amount of money on the table, mainly through crypto-investing rookie errors.

When I wasn't sure, I'd guess.

I was the guy who bought the top of a cycle only to panic sell the bottom, thinking everything was going to zero. Then, when an inevitable bull run returned, I chased that moving target back up.

Patience isn't just a virtue — it's a damn superpower because Crypto always allows you to play catch up, even in bull markets.

I've used money to invest in Crypto when I needed to pay bills, and I've also used leverage and collateralised loans to borrow against Crypto. None of it worked out, and it all screamed a lack of patience and, if I'm honest, part greed.

If this makes you cringe, I'm right there with you — I'm wincing too. But I'm glad these royal screw-ups happened.

It's like an old buddy once said to me:

"Jay, making mistakes is good, but if you repeat them, you're a bloody idiot".

My frequency of errors and missteps has decreased to the point where I only need subtle nudges to keep me on course.

I share these early blunders because they're relatable. You might even be nodding along right now.

They are hard truths I wish I’d known from the start.]

The one framework to succeed from day one.

I finally squeezed the juice from a cryptocurrency trade when I made good on my 2018 Ethereum and Bitcoin investment because I understood this simple framework.

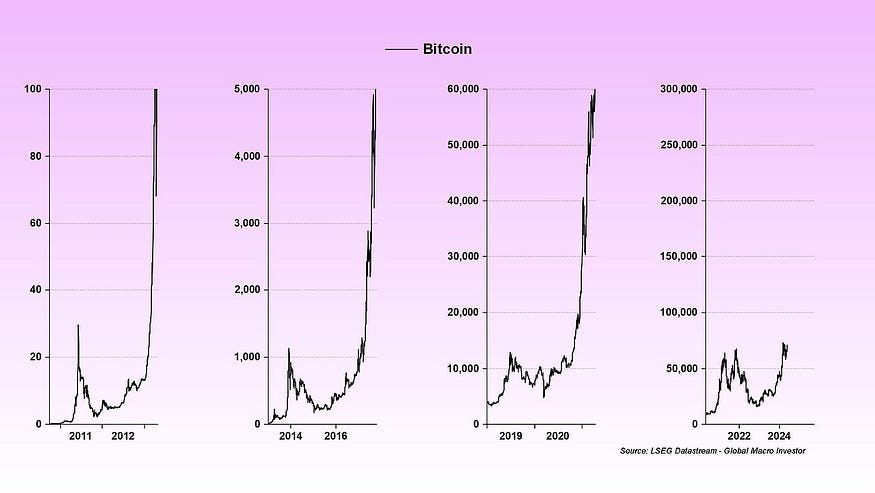

It's the 'four-year cycle'.

The top business cycle expert in the world, Julien Bittel, calls it the "Everything Code."

It starts with a sequence of events that match each other, dating back to 2008, and is expected to continue until 2030.

In 2008, after the global financial crisis, all significant economies decided to give themselves a debt jubilee by sending interest rates to zero.

So here you have the start of a business cycle. The stock market bottomed, and it was the start of a debt refinancing cycle (3–5 years). Interest rates went to zero, which matched the election cycle, with Obama beating McCain in 2008. Most significantly, Bitcoin also came out in 2008.

These events, which drive liquidity in the system and have a stimulative effect on asset prices, match each other and are in sync. Once I understood this, I knew directionally where things were headed and where we were in the cycle.

As the saying goes — "Once liquidity changes, everything changes".

Here's the kicker.

Hardwired into the Bitcoin protocol is a halving event that reduces the supply of new Bitcoin every four years.

So, all of these events mirror each other, which is significant because you can, with a substantial degree of accuracy, tell when the next bull market will be and when we are due for a downturn.

It's all driven by liquidity — here's where we are compared to previous cycles.

Peg yourself to this one metric.

Your time horizon.

It's significant because it tells you where the finish line is within your own personal circumstances.

It’s a profound framework to channel out external noise.

Not having a time horizon set is like starting an ultramarathon and not knowing when or if you'll ever see the finish line.

Setting my time horizon became the cornerstone of investing because it allowed me to work my way back from that endpoint. It also sets a framework for how much capital I can have tied up for that period.

For many of my readers here who may impulsively dive into Crypto, the horizon helps you size your position.

In the days when time horizon wasn't a consideration, I'd be in a constant state of chasing pumps or getting sucked into adding to my position.

This cycle, my plan is to cash out one-third of my holdings by February—sometime after the inauguration—and then again in April or May, typically around altcoin season after tax season. The remaining portion, I’ll run until the end of the cycle.

If we go on a golden run, I can take another 30% off the table. But here's the thing: having that time horizon in place allows me to be in control and not emotionally react to the market volatility.

It also allows me to allocate an amount within my budget that I can set and forget, then take a step back and enjoy life.

It's so much better than being in this constant state of FOMO.

Stuff FOMO, stay concentrated.

I always found losing money in Crypto to be a tough pill to swallow, but over time, you get over it, and if anything, 70% of corrections or being completely underwater become a gift from the Crypto gods to add to your position.

The trickier part? Staying sane while Crypto heads to Valhalla.

I have experienced two separate bull runs previously, and in the last bull run, I rotated out into NFTs, and in the previous one in 2017, I bought some sh*t coins.

The reality is that had I stayed concentrated by owning a mix of the top three assets, Bitcoin, Ethereum, and Solana, and added to my position, I would have done remarkably better.

Don't kid yourself like I did that you need to get "diversified". When all assets rise optically together in a Marco trend upwards, diversification does absolutely nothing.

Singular concentrated bets on blue-chip assets with a long-term time horizon and being as dull as a never-ending cricket match are the answers.

Stay focused.

Stick with the programme.

The hidden reasons why only spending what you can afford to lose is smarter than you think.

Whenever I heard someone say, "Only invest what you can afford to lose," I zoned out like I was listening to some health and safety officer, but the magic is in the detail here.

Spending what you can afford to lose A: stops you from chasing and being a silly billy like using leverage, but B: When you can afford to lose it, it feels like house money you're using, which has this jujitsu effect on your mindset, and it allows you to ride the volatility without a single solitary hiccup.

The most important thing it does is quietly stretch your time horizon—because you’re way more chill about your investing approach. "Time in the market beats timing the market" isn’t just a saying; it’s a truth you can take straight to the bank.

It's a gift to go quiet and almost pretend you don't own something while everyone loses their minds in both bull and bear markets.

I'd forget I even owned Crypto, and while my coins were in hibernation in my crypto wallet, I went about everyday life as usual.

This concept of only spending what you can afford to lose made me less time-sensitive.

It's how my $800 in Ethereum went to $40,000, and I hadn't even broken into a sweat.

Stop thinking like a dinosaur.

Whenever I sold Crypto in those early days, it had no purpose.

I'd ask myself, "Why have I just sold an asset that will increase in price forever?"

It messes you up because even if you time the top of one cycle and turn your $1,000 investment into $10,000, you are unlikely to re-enter at $10,000 out of fear of losing it all.

Trust me, you won't put it back in.

Some of my early gains in Crypto were redirected back into stocks because I was very much stuck in the mindset of investing in traditionally proven assets.

I understand crypto much better now, and I've realised that any other investment outside it is suboptimal.

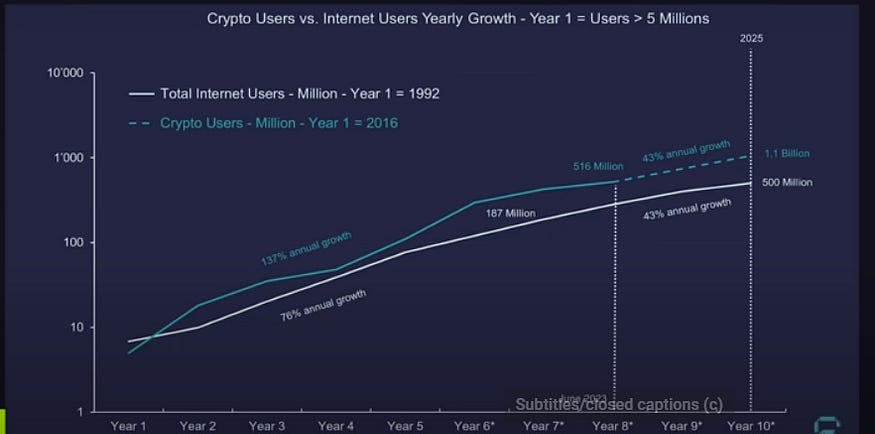

Crypto is a macro trend—upwards and onwards—because the world’s only getting more digital, not less. Sure, there’ll be plenty of losers, but sticking to the top four cryptos and playing the long game is how you come out ahead.

Crypto users are growing at 137% per year, which dwarfs the adoption of the internet, which had 76% growth during the same period.

Look for safety signals.

I walked into a marketing meeting once, and the business owner said:

“Thinking outside of the box is nonsense — all we do is find the best business in the industry and copy what they do. We think inside the box, but we do it better”.

There's a profound lesson in all of this: search for safety signals from the best people in the industry — or, as Crypto Twitter calls them, "the smart money investors."

My one cardinal sin, which I repeated like a stuck record, was clinging to an idea or a narrative I'd read or someone had told me and not sharing it out of fear of scrutiny.

I’d end up stuck in an echo chamber, surrounded by people feeding me a steady supply of bad ideas. Ideas need to be challenged, which is why I actually appreciate when people troll me every time I talk about NFTs. It’s how your ideas either crumble or become so strong that you’re ready to take meaningful action on them.

I follow all the best Marco, finance, and crypto experts in the space and dig into their thesis.

It's like following the wisdom of the crowd.

When I absorb 15 to 20 points of view, the same answer tends to surface like an undeniable truth.

Stop thinking like Peter Pan.

I mentioned earlier the famous billionaire business analyst Kenneth Fisher once said, "Time in the market beats timing the market."

I used to feel gut-wrenching frustration whenever I missed selling at the top or didn’t buy in at the bottom.

What changed over time was accepting that no one—no matter how smart—can predict the short-term market with any real certainty. Through gritted teeth, I’ve come to terms with the fact that I’m no Nostradamus.

So I quit my child-like fantasies of: "Imagine if I put my life savings in right at the bottom and look where it would be now". If my grandma had wheels, she'd be a bike.

It's unhinged from reality.

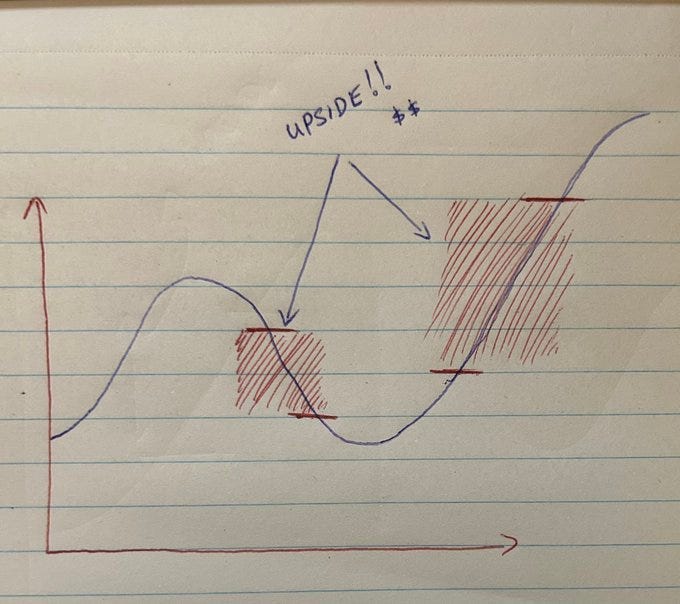

Life changing money is made between these two points, so there's enough meat on the bone without thinking you've missed the boat.

Final Thoughts.

The beauty of the crypto market is it always gives you an opportunity to catch-up.

The problem is its volatility, which can take your emotions by the kahunas and make you do weird stuff.

One of the top Crypto experts who goes by the Pseudoanynmous name Beanie says:

“If you missed something, just accept that you missed it. Otherwise, you’ll be in an infinite death spiral instead of a money glitch.”

He's right — 2021's bull run had 13 drawdowns, which would have given you a reasonable entry point.

You've got more time than you realise, so pump the brakes — no need to rush.

They're hard truths about crypto I wish I'd learned sooner.

Great advice. Can you explain your reasoning for DCAing out in January and April/May though? I thought this bull run is going till end of the year possibly? January to take a third out seems early. Do you see it as a kind of "sell the news" type event where price might actually dump a little after because all the optimism of the new presidency is already priced in?