This Tech Visionary Disagreeing With Warren Buffett Shows Why Staying in Your Circle of Competence Is the Ultimate Superpower

It’s the answer to mastering yourself.

Author note: If you decide to upgrade to my paid subscription, you're not just supporting my writing career; you'll also get some of my best work, filled with deep research, in a bite-sized blog for the price of a coffee.

Thank you for being a subscriber. Your support means a lot to me.

Hope you enjoy the piece below.

I’m a Warren Buffett disciple.

I also love geeking out on finance topics, some with unnecessary jargon and others with exquisite simplicity.

Staying within your “circle of competence” is a simple but profound concept you can apply to any part of your life, and it comes with a heavy endorsement from the world’s most significant investor.

In my early 20’s, I read the world-famous book The Intelligent Investor and Chapter 8 multiple times.

Buffet says to reread that part of the book until it’s etched into your memory.

The chapter is titled “The Investor and Market Fluctuations”, and its simple message sure as heck came in handy when I started investing in my company’s stock in the middle of the 2008 global financial crisis.

People were scared sh*tless to invest, even though the prices were bargain basement.

Chapter 8 taught me that true investors buy low when there’s maximum fear and sell high when there’s ultimate greed, and at no point should market fluctuations and price swings impact you.

Instead, it would be best to focus on the underlying asset’s “intrinsic value” and the reasons you invested in the first place.

Whether I meant to do this or not, I understood the company inside out and intuitively followed the message in the book, which could have spelt out that my Circle of competence had grown.

I certainly wasn’t guessing or deluded.

I worked 40 to 50 hours a week and made automatic monthly investments after payday, which after four years resulted in the first significant amount of money I earned from an investment.

Chamath Palihapitiya and Warren Buffett come from contrasting backgrounds, shaping their investing philosophies.

Chamath’s family fled war-torn Sri Lanka when he was a child, and the hyper-vigilance he carries with him in his career is a product of his father’s abuse.

In contrast, Warren grew up in America, and his father was a stockbroker, giving him a financial literacy headstart.

Both have distinctly different backgrounds but believe in sticking closely to what you know and your expertise.

It’s a strategy that’s made Buffett the 5th wealthiest man in the world, with a net worth of $119 Billion.

Chamath Palihapitiya is now a hugely influential tech visionary and investor with an estimated net worth of $1.2 Billion.

Recently he challenged Buffett’s open denial and scepticism of Cryptocurrencies, pointing out that technology was not in Buffett’s Circle of competence.

It was after Buffett’s comments that he “wouldn’t give you $25 for all the Bitcoin in the world” and that it’s “rat poison squared”.

Chamath Palihapitiya’s — Source

“Not everybody is right all of the time, and we have to acknowledge we have biases.

One of the things Buffett has said for years, which I believe, is you define a circle of competence and stay within it.

It’s been clear his entire investing career that technology is not in his Circle of competence.

The only technology he’s ever owned is Apple”.

The track record of the two contrasting investors teaches you that both are entirely right about what they know and have been competent enough to stick to it.

It’s not a weakness to not know something if you can define everything you aren’t good at; it’s the ultimate superpower.

While these principles apply to investing, they are also a metaphor for all aspects of life.

Buckle up, and let’s get into it.

The size of your Circle is irrelevant.

Buffett is the epitome of defining and staying within your Circle of competence.

As a kid, he was mesmerised by a persistent curiosity to produce profits, and it helped that he was freakishly bright.

His success is no accident.

At 11, he was investing in the stock market and starting businesses selling products door to door.

It put those classic lemonade stand stories to shame because this child prodigy from Omaha ran businesses on steroids.

Buffett now invests in promising companies that have underlying productivity you can measure.

You can see his investor DNA originating from his childhood experiences.

He says the skills you master throughout life lie inside your Circle of competence.

When he bought Nebraska Furniture Mart for $60 million from a Russian woman called Rose Blumkin, who couldn’t read or write, he summed this up perfectly.

Warren Buffett — Source

“I couldn’t have given her $200 million worth of Berkshire Hathaway stock because she doesn’t understand it.

She understands cash.

She understands furniture.

She understands real estate.

She doesn’t understand stocks, so she has nothing to do with them.

If you deal with Mrs B in her Circle of Competence. She will buy 5,000 end tables this afternoon. She will buy 20 different carpets in odd lots and everything else because she understands carpets.

She wouldn’t buy 100 shares of General Motors if it were at 50 cents a share.

The most crucial thing in business and investments is accurately defining your Circle of competence.

It isn’t a question of having the biggest Circle of competence.

I’ve got friends competent in a much more significant area than I am, but they stray outside it.”

The part of this story that stands out is that having such a narrow focus didn’t hurt Mrs B.

It was the entire opposite.

Her unwavering focus on what she was good at led to her extreme success, even though she spoke broken English and couldn’t read or write.

Here’s what happens when you can’t recognise your incompetence.

McArthur Wheeler covered himself in lemon juice, then walked into two Pittsburgh banks and robbed them in broad daylight without trying to disguise himself.

Police arrested him later that night, less than an hour after surveillance cameras showed his face splattered on the 11 o’clock news.

When police showed him the surveillance tapes, Mr Wheeler stared in disbelief. “But I wore the juice,” he mumbled.

Mr Wheeler was under the impression that rubbing your face with lemon juice made you invisible to videotape cameras.

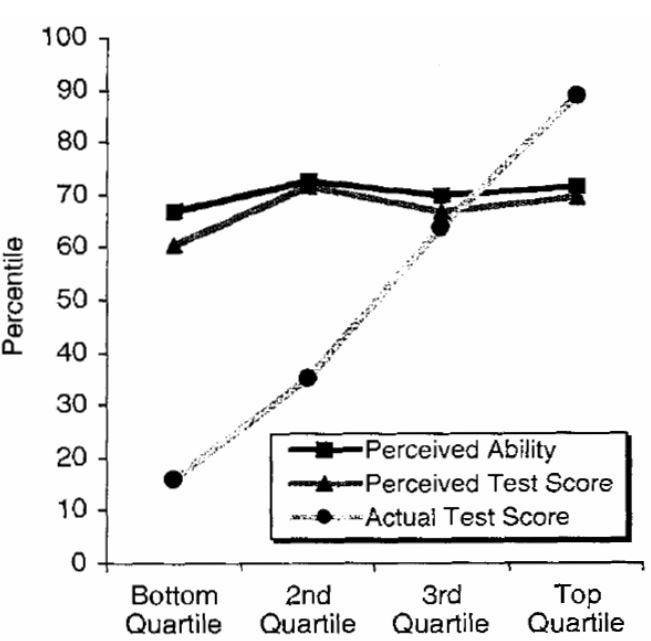

Researchers David Dunning and Justin Kruger coined the “Dunning-Kruger Effect”, where people tend to think they’re good at things even when they’re not.

They also cited this robbery in their research paper.

They argued that people who were competent in some areas tended to undervalue themselves, and the opposite would happen where incompetent people would overestimate their value.

They concluded that the skills you need to be good at something are the same skills you rely on to understand if you’re not good.

People who aren’t good at something find it harder to judge their Circle of competence.

They suffer from two things.

They come to the wrong conclusion about their ability and make poor choices.

Their incompetence robs them of the ability to realise it.

The study showed almost a level of delusion when people played outside of their Circle of competence.

Across four studies, the authors found participants scoring in the bottom 25% on tests for humour, grammar, and logic grossly overestimated their test performance and ability.

Although their test scores put them in the bottom 12%, they estimated themselves to be in the top 62%.

Final thoughts

It’s all a metaphor for life.

Stick to the areas that you know and make them better.

People like Buffett and Palihapitiya achieved significant feats, starting with what they knew. What they grew up doing and what they were good at.

They weren’t rubbing lemon juice in their face.

It’s an incredible tool for self-awareness; once you start to think about your Circle, you begin to define what you’re good at and the things you’re not so good at become clearer.

You’ll beat yourself up less for what you’re rubbish at doing once you draw these parameters, and you’ll realise it’s not the size of the Circle that counts.

It’s what’s in it, how well you can define it and how long you can stay there.

One skill mastered against a bunch of average ones will take you far beyond anywhere you could ever go.

These are strategies for life.

Stay within your Circle of competence and make the most of what’s in it without being deluded.

It’s the answer to mastering yourself.

🙏