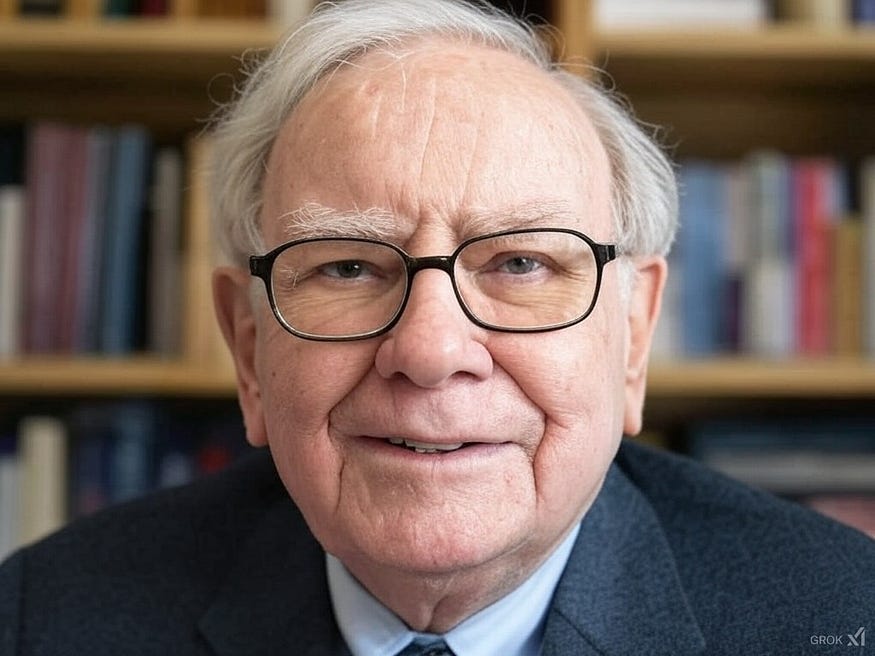

Warren Buffett Just Sold $133 Billion in Stock: Does He Know Something We Don’t?

It’s a stock market signal that’s becoming hard to ignore.

Every now and then, I dip into the traditional finance world to see what the sharpest investors are saying about the space.

Today’s newsletter is free for all subscribers, but it’s the paying members who keep this running—so a massive thanks to those who support.

Hope you enjoy this one.

Warren Buffett once joked he’d jump off Omaha’s tallest building if he weren’t a millionaire by 30.

At just 14, he was already using the now-famous compounding strategy: placing pinball machines in barbershops, splitting the profits 50/50 with the barber, and using his cut to buy even more machines.

By 21, he’d already saved $20,000 (about $220k today) from delivering newspapers, selling golf balls, and running the pinball machine business.

The now 94-year-old is worth $141 billion, and he’s pledged to give all of it to five different charities after his death.

What I love about Buffett, aside from his generosity, is how his quiet humour shuts down critics who say he’s too rich to sit on all that cash.

It stops them in their tracks.

The Wall Street wizard once joked that he’ll still be running Berkshire Hathaway from beyond the grave. However, his successor, Greg Abel, will soon decide on stock picks and asset allocation.

“That decision actually will be made when I’m not around, and I may try and come back and haunt them if they do it differently. But I’m not sure the Ouija board will get that job done.”

Buffett and his heir, Greg Abel, aren’t keen on U.S. stocks right now.

Between early 2022 and mid-2024, they unloaded billions from Berkshire’s core holdings, boosting their cash pile by 200% to a staggering $325 billion.

(Note: Buffett’s cash pile is 27% of assets, above the 13% average since 1996 but still well below the 40% peak in 2004.)

There’s more.

According to an SEC filing, they’ve offloaded 150 million Bank of America shares for $6.2 billion, trimming their stake by 14.5%. However, they’re still a top shareholder with an 11.4% stake worth around $36 billion.

With $133 billion in stock sales in the last nine months of 2024 and more sell-offs expected, investors are starting to sweat.

Buffett and Abel’s cash pile signals that a crash might be coming.

All signs are pointing in one direction.

During Berkshire Hathaway’s annual meeting, Buffett said, “The incredible period of growth for the U.S. economy is ending.”

Before he passed, Buffett’s long-time partner, Charlie Munger, gave a blunt warning:

“We should get used to making less.”

Then there’s Jamie Dimon, JP Morgan’s head honcho, who calls now “the most dangerous time the world has seen in decades.” After all the fiscal and monetary stimulation, he’s cautious about what 2025 could bring.

British investor Jeremy Grantham, a master at spotting market bubbles, puts the odds of a recession at 70%. He thinks the S&P 500 could drop by another 50%.

As he puts it:

“I think of myself as a realist trying to see the world as it is, not how I’d like it to be. Sometimes I get it right, sometimes I don’t.”

In 2023, U.S. GDP hit $26.97 trillion, while the national debt climbed to $33.17 trillion — a debt-to-GDP ratio of 123%.

By 2024, GDP grew to $28.83 trillion, but debt surged to $35.46 trillion. The result? The debt-to-GDP ratio stayed at 123%, lower than some had predicted but still an eye-watering number.

The reason would be the sustained high interest rates and the fact there’s $7 trillion still to roll over in national debt.

The higher that number climbs, the harder it gets for the government to pay off its debt.

Famous hedge fund manager Bill Ackman says:

“The country has a lot of intrinsic value, including owning a 35% stake in our income through taxes, which it can adjust at will by changing tax policy. While the U.S. has enormous assets — like real estate and infrastructure — the growing liabilities, such as debt, Social Security, and healthcare costs, are concerning”

One signal to watch.

I’ve quickly realised that top investors use the ISM (Manufacturing Index) to predict future productivity and corporate profits.

Buffett’s already seeing the tougher road ahead for businesses, and the data’s backing him up.

Warren Buffet:

“I get reports on what businesses are doing, and in retail, they’re down 22% in sales. Some are just living off orders from months ago.”

With Berkshire Hathaway’s market cap sitting at $1.02 Trillion and the cash reserve growing at 7% yearly, Buffett is clearly waiting for the right moment to strike.

That pile of cash could buy Samsung, Coco Cola or even Bank of America with change to spare.

He’s watching the numbers daily:

“Supply lines were hit hard (during lockdowns), so no economic figures are pure, but I’m telling you, I look at sales daily, and they’re down.”

The ISM appear to be showing signs of recovery.

This index surveys 50,000+ executives across 400 U.S. manufacturing companies monthly, giving a solid read on the economy’s direction.

For 70 years, the ISM has nailed every U.S. recession.

A score under 50 signals contraction and possible recession, while anything over 50 means growth — and if it hits 60, we’re in boom mode.

Right now, we’re at 50.09, and Investing guru Raoul Pal says there are signs of recovery creeping in.

He has a different view of things, which is not to focus on the ISM’s current position — it runs in cycles. When it drops, a recession often follows, and when it climbs, expect a boom.

It’s now showing clear signs of recovery.

Aim to be the person with a chair when the music stops.

As Buffett says:

“Your investment thesis will be right because your data and reasoning are right.”

He doesn’t care about making market forecasts — he’s focused on investing people’s money in the safest risk-adjusted places.

His strategy:

“We just want to be the last man standing, and if that means missing out on price appreciation by avoiding leverage, so be it.”

The Oracle of Omaha has successfully navigated six U.S. recessions and countless market corrections and says:

“Nobody else can make a deal like we can when the time is right,”

His secret weapon is having the patience of a sniper holding out for the perfect shot.

When companies struggle or face borrowing issues, cash becomes a huge advantage.

Buffett believes a great CEO doesn’t freeze when others do — they jump at opportunities no one else will touch.

He’s suggested that as their cash pile grows, navigating turbulent times will become even more thrilling — hinting that Greg will have even more fun managing it.

Warren Buffett:

“Good companies might not want to sell, but they may need $20 billion. Several decent companies could find themselves in a tight spot with their borrowing structure, and when that money comes due at the wrong time, that’s when the phone calls start. And those calls are limited.”

Final thoughts

People are fixating on Buffett’s stock selling like it’s some kinda signal the market will capitulate.

Buffett’s not playing fortune teller, nor should we — he’s just sitting on a mountain of cash, waiting for the right moment, and the truth is nobody knows what’s coming next.

The world’s fifth richest person is playing it safe, leaning into a risk-off strategy as we face a reinforced debt cycle, potential world conflicts, and uncertainty everywhere.

Even if financial conditions take a hit, asset prices can still keep climbing. Why? Because the money printer never really stops. If the economy struggles, they’re even more likely to fire it up again.

As global liquidity expert Mike Howell puts it, stock prices reflect central bank balance sheets — when that increases, so do asset prices.

“If you have an expanding Fed balance sheet and an expanding injection of capital, that’s a recipe for very strong global liquidity. The best time for asset prices is when economies are slow and sluggish, but policymakers are trying to stimulate them, and that’s what we’ve got.”

Warren Buffett selling stock?

That might be one signal worth ignoring.

If you enjoyed reading this article, please share it—it’s how Carrot Lane grows.

the last time America imposed this many tariffs, we had the Great Depression. he knows history

WB is getting old. He has been doing this since last year. I just have a feeling that he’s preparing his estate to make it easier for his heirs.