What Trumps Tariff Game Means For Crypto (Very Few Understand).

Sometimes what we see and hear isn't necessarily what's happening under the hood.

When crypto prices were getting hammered by tariffs, I sent this blog out three weeks ago. Now, I’ve made it free for all subscribers.

To the paying subscribers who support Carrot Lane—I appreciate you more than you know.

For those still on the fence, an annual membership is nearly 40% off and comes with a free one-on-one strategy call—whether you're new to crypto or deep in the game.

Founding members get even more: an hour-long one-on-one, monthly group calls, and access to a private daily chat.

If you’re serious about this cycle, now’s the time.

It’s been a rough one in the crypto trenches.

Deep Seek AI wiped nearly a trillion off the markets, and Trump’s tariff threats have turned global trade into a battlefield, with countries firing back.

He’s hurling tariffs around like a guy who just found the "increase" button—2.5% across the board, 10% on Chinese goods, 25% on imports from Canada, Mexico, and Colombia, and a full-blown 100% on China if they even consider abandoning the dollar.

The fallout for crypto has been brutal. This is the worst drawdown since the pandemic, as risk assets fell faster than a broken elevator due to an anticipation of tightening financial conditions.

However, not everything is as it seems, and Trump’s famous book The Art of the Deal might hold the answer.

One line reads:

“MY STYLE of deal-making is quite simple and straightforward. I aim very high, and then I just keep pushing and pushing and pushing to get what I’m after.”

Somewhat ironically, Trump's current Secretary Treasury, Scott Bessent, a former hedge fund manager and a guy in charge of negotiating trade deals and overseeing the nation's finances, wrote to his investors one year ago (almost to the day).

What he said was astonishing.

Scott Bessent:

“We find it unlikely that across-the-board tariffs, as currently reported by the media, would be enacted at the same time as he (Trump) moves to fix the immigration crisis. The tariff gun will always be loaded and on the table but rarely discharged.

Another differentiated view that we have is that Trump will pursue a weak dollar policy rather than implementing tariffs. Tariffs are inflationary and would strengthen the dollar--hardly a good starting point for a US industrial renaissance.

Weakening the dollar early in his second administration would make U.S manufacturing competitive. A weak dollar and plentiful, cheap energy could power a boom.

The current Wall Street consensus is for a strong dollar based on the tariffs. We strongly disagree. A strong dollar should emerge by the end of his term if the US reshoring effort is successful.”

What Bessent is really getting at is that we probably won’t see broad tariffs hit—but they’re being used as a stick to beat world leaders with.

He thinks Trump is more likely to initially push for a weak dollar policy. This would make American manufacturing more competitive with cheap energy and boost industrial activity.

When the dollar is strong, U.S. goods and services become more expensive for foreign buyers, and exports drop as other countries reduce their purchases of American products. This impacts businesses that rely on international sales.

On the other hand, cheaper imports sound good for U.S. consumers but can actually hurt local businesses that now have to compete with cheaper foreign goods.

This goes against the public narrative that a strong dollar is fantastic.

With rates staying high and U.S. treasuries in demand, the dollar isn’t just holding its ground—it’s charging ahead with a textbook cup-and-handle pattern.

Anthony Pompliano taught us a valuable lesson few expected to hear.

Stick with me—this all circles back to crypto.

Bitcoin and crypto commentator Anthony Pompliano compared Trump’s first-term tariffs, their impact on everyday goods like washing machines and solar panels, and the potential inflationary effect on pricing.

But first, a little history.

In 1789, George Washington signed the second-ever U.S. law, imposing a flat 5% tariff on all imports. Back then, there was no income tax. The government ran entirely on tariffs, and this system lasted for about 70 years.

By 1850, the U.S. started lowering tariffs to encourage trade. Over the next 100 years, tariff revenue dropped from over 90% of government income to nearly zero. At the same time, income tax was introduced in 1913, and by 1950, it had exploded as the primary funding source.

As Pompliano puts it, and it’s a point I agree with, "We went from taxing other countries and corporations to benefit American citizens to taxing American citizens to benefit other countries and corporations."

He goes on to say:

“In 2018, during President Trump’s first administration, he implemented tariffs on solar panels, washing machines, and steel. The idea was that he would protect American industries.

He would introduce an increase in American manufacturing. He would create more American jobs. He would bring down the price of American goods. He would avoid inflation, and the government would generate more revenue.

Plenty of critics yelled and screamed, arguing that tariffs are inflationary—that they drive prices higher and actually hurt consumers rather than helping them. But I looked at the data, and the critics were wrong.

Instead, here’s what happened:

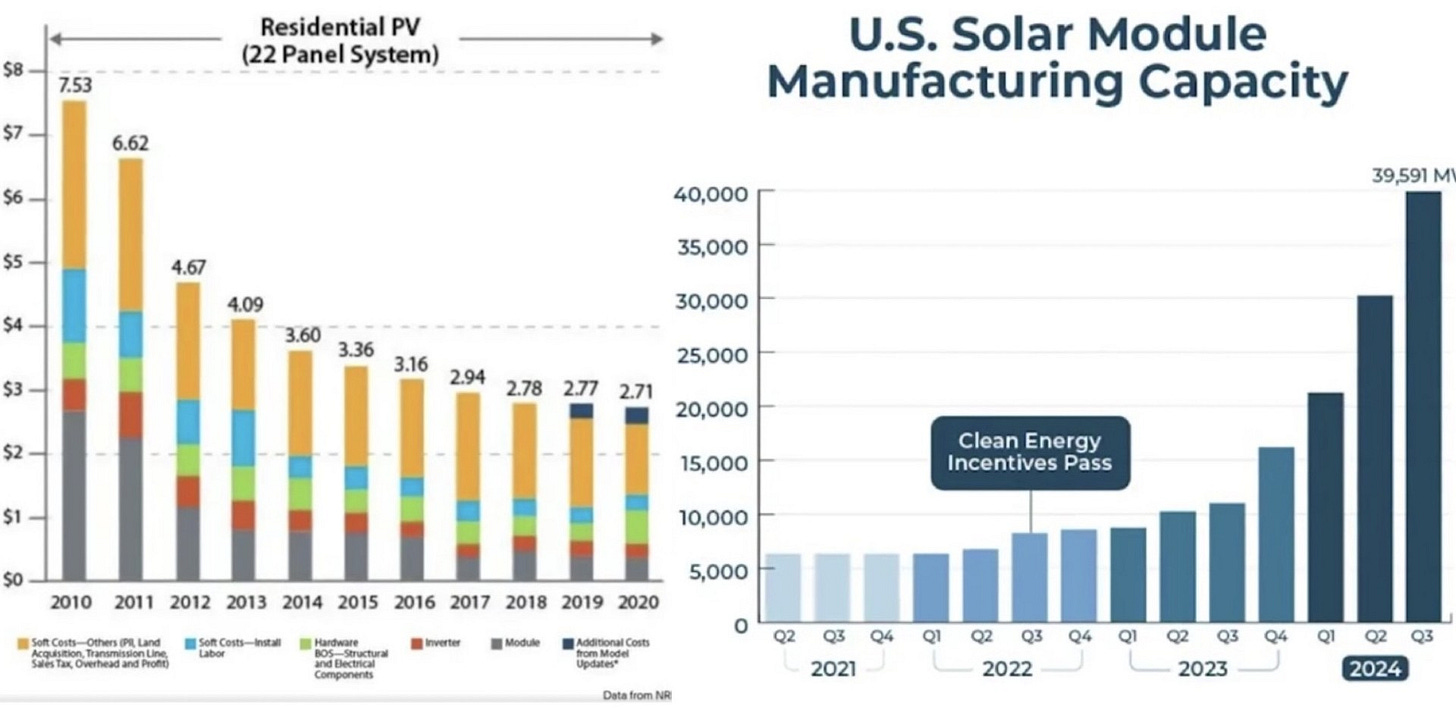

Solar panel prices went down. Now, solar panel prices had already been declining for a while—technology is deflationary. As technology improves, products become cheaper, just like how TVs are far less expensive today than they used to be. So, when tariffs were introduced in 2018, solar panel prices continued to drop.

On top of that, American manufacturing of solar panels actually increased.

By introducing tariffs on foreign-made solar panels, American companies gained a competitive advantage and began producing more.”

The two charts below show how pricing plays out—and this isn’t some cherry-picked anomaly. What usually happens is an initial spike in inflation, followed by increased production and then downward pricing pressure on the goods.

This is one example of solar panels: as manufacturing ramped up, the price of solar panels decreased.

The reverse repot is running on empty.

The Federal Reserve’s Reverse Repo Facility just hit its lowest level in 1,386 days.

This is where banks and big financial firms stash their extra cash with the Fed for a small interest payment. When that balance shrinks, there is less excess cash floating around. It means liquidity is drying up, and financial conditions are getting tighter.

That usually means risk-taking slows, and asset prices like stocks and crypto start feeling the pressure.

It results in the opposite effect.

We know that when conditions squeeze or liquidity dries up and markets struggle, the Fed tends to intervene—either by cutting rates or firing up the money printer to pump liquidity back in.

Right now, it’s sitting at just $85 billion.

Final Thoughts.

Trump’s company, World Liberty Finance, just scooped up 86,000 ETH in the last 48 hours, bringing total holdings to $421.7M, with Ethereum now making up 65.34% of the portfolio.

Right now, we’ve got a cocktail of financial conditions fueling the volatility.

Trump’s tariff strategy is straight out of his "Aim high and scare the hell out of everyone" playbook. In negotiations, I expect interest rates to stay locked and loaded—either as the bullet in the chamber or, to put it more gently, the dangling carrot they’ll use to push countries into a deal.

A strong dollar is just a byproduct of high interest rates driving demand for U.S. bonds. However, Trump needs a weaker dollar to kickstart U.S. manufacturing.

All signs point to the Fed pivoting sooner rather than later—likely as soon as a trade deal is on the table.

This would set the stage for China to fire up its printing, liquidity to flood back in, and asset prices to rocket straight to Valhalla.

From what I can see, the game being played here is that Tariffs are a high-stakes bluff to force a better deal for the US. The media paints it as an economic wrecking ball, but history suggests otherwise.

Whatever your politics, if this works, it may well be a Trump masterclass. Or we could see sustained and suppressed price action if it drags out longer.

It’s what Trump's tariff game means for Crypto that few understand.

If you found the information in this blog helpful, please feel free to share it—it’s how Carrot Lane grows.