What Tyler Winklevoss Knew About Bitcoin That We’re Finally Realizing.

Traditional finance folks are still oblivious.

I've been spending more time lately talking to folks who have all sorts of reasons why Bitcoin is supposedly going to zero—it honestly makes me laugh. But it’s also a great chance to sharpen my thesis on why it won't.

This blog comes as close as possible to explaining that.

Big thanks to all our new subscribers! Today’s newsletter is only possible because of the support of my paying subscribers—who get direct access to me for questions, Zoom calls, or comments on my posts.

As a bonus, I’m offering 40% off the annual subscription—really makes it worthwhile.

Hollywood did a great job of selling us that Cameron and Tyler were your typical pantomime villains in the film The Social Network.

Every storyline has to have its bad guys.

The Twins, in the movie, are portrayed as two wealthy Harvard brats.

In the film about their lives, Mark Zuckerberg is portrayed as somewhat of a hero, but the story leaves it open to interpretation, especially given the controversy over him allegedly stealing the idea for Facebook.

Despite missing what seemed like a once-in-a-generation financial win with Facebook, both brothers have found incredible success, diving into the counter-culture world of cryptocurrency—which is becoming more mainstream every day.

The pair appear to be winning the most significant network of them all.

The money network.

It came after a random run-in on a beach in Ibiza, a stranger recognized the twins from the movie and asked if they’d heard of Bitcoin.

That chat sparked their curiosity, sending them down the Bitcoin rabbit hole and into its community.

Not long after, Cameron and Tyler realised they were looking at "Gold 2.0."

They saw straight away that the network effects, unlike Gold, made it a better version of Gold.

“We were used to social networks but realised this was a money network—you could for the first time send value on the internet like an email”

Metcalfe’s Law.

Together, both men own a staggering 70,000 Bitcoin, most of which they purchased for $8.

I’m amazed at how some folks still don’t get it.

Take Dave Ramsey, a well-known financial expert who helps people get out of debt. Recently, he described Bitcoin as “thin air”.

He says the whole concept is:

“Mist and smoke and mirrors. Bitcoin is a currency and it has no value. It can’t be treated as an Investment. Stocks are based on a companies performance, productivity and revenue created”.

This is the most significant mistake people are making with Bitcoin.

They apply old frameworks to a new technology with an entirely different value proposition.

People say things like, “It’s not a productive asset”. But that’s not where the value is driven from. It’s actually from the people joining the network where the utility increases. AKA Metcalfe’s Law which simply states —the more participants there are in a network, the more utility and value it has.

Not productivity in the traditional sense.

Tyler Winklevoss explains:

“When you realize money is the greatest network of all, Bitcoin is maybe the greatest social network of all. The way you value a social network and network effects is Metcalfe's Law. You do not look at it like a cash producing company, or an equity and try and do some discounted cash flow model.

That is why a lot of like Wall Street and finance people go astray, because they take their frameworks, they’re like, wait, it’s not a company with cash flow, it’s worthless, there’s no intrinsic value.

Instead they should look at it, like how you value Facebook, and how each additional user provides additional utility to the other users without even knowing it.”

Network effects are unbreakable.

This was a significant unlock for me.

Realising that Bitcoin and Crypto in general are not just currencies—they are network adoption models, so the key metric is, you guessed it, network adoption.

Each new user adds additional strength and utility to the networks they are in because people, being people, become the biggest supporters and proponents of the networks.

You’ve heard of Bitcoin maximalism, right? If not, just try saying something negative about the "prodigal coin" of crypto and watch what happens. You’ll have a cult-like, religious group of Bitcoin diehards in your comments, pitchforks ready.

If that’s not enough, just have a look under the hood at the data.

Bitcoin holding patterns:

37% of Bitcoin Supply Dormant Since 2017 ATH: Around 37% of Bitcoin (~7 million BTC) hasn't moved since the all-time high in December 2017. Shows that a huge chunk of holders are in it for the long run.

55% of Supply Unmoved Since Late 2018: Over 55% of circulating Bitcoins haven't moved since the market bottom in late 2018. Long-term holders are strong here.

Dormant Supply: Out of a total circulating supply of 19.574 million BTC, over 14.9 million (around 76%) have been held off exchanges and have not moved for over 155 days. This indicates a strong presence of long-term holders, with short-term holder supply being at an all-time low of around 2.3 million BTC.

On-chain transaction data shows that the same coins are mostly being moved around frequently, which suggests that most Bitcoin holders hold the coins long-term, making supply relatively illiquid.

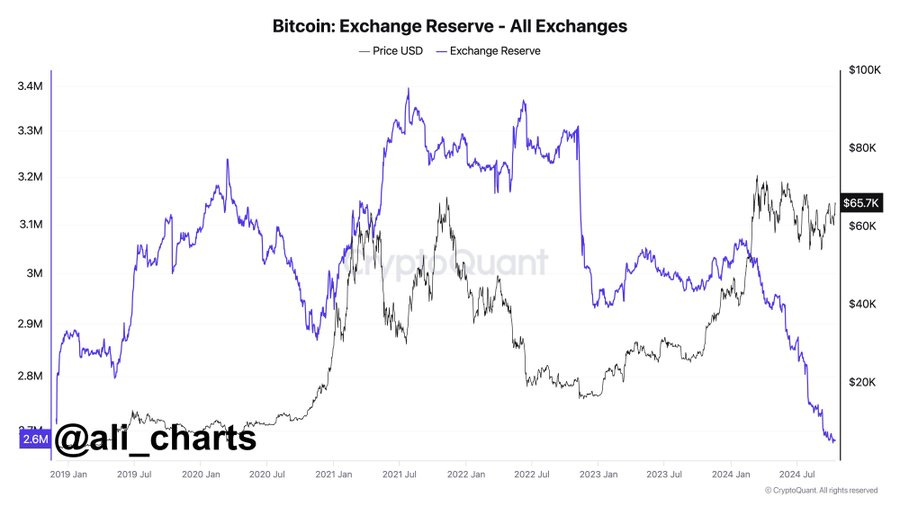

It is so illiquid that the supply of Bitcoin on exchanges has now hit a 5-year low.

Tyler Winklevoss explains the resilience in holding BTC by saying that people in these networks become their biggest advocates, "consciously and unconsciously" fending off other ideas.

As more people join, the utility of the network has this compounding benefit.

“If I am the only person in the world who has a phone, it is not that valuable, because who do I call? All of a sudden, if you buy a phone then I can call you, and by you purchasing a phone, you have brought utility to me. The more people in the world that do that, the more valuable the Metcalfe’s Law effect is.”

The signs are already there with big tech.

I never noticed it before, but all these big tech giants with massive market caps that nobody can knock off their perch come down to one thing—they've got the most robust network effect.

“We know how strong network effects are, because we see the market cap of Google, Facebook, and big tech, and how hard it is to unseat these companies. Google took a run at social. It was called Buzz. It fell flat on its face, because one of the things about network effects is that users become the biggest champions of the network.”

Tyler puts it simply—nobody wants to upload their pictures 10 times to 10 different social networks. Once you pick Facebook or your platform, "you try and kill all the other ideas because you just don't want the overhead."

People don’t want the hassle of learning something new or rebuilding all their connections again.

We’ve all become our own ambassadors for that.

"It's really hard to unseat even almighty Google, which was much bigger than Facebook back then. When you have the first money built for the internet, with the social network effects of money itself, and you put Bitcoin next to gold, you realize Bitcoin equals or even surpasses gold in all the traits that make gold valuable. This is a really big idea."

Bitcoin’s hidden multiplier effect.

There is a disjointed effect people don’t talk about when you have a crazy clan with no sellers.

It’s called the Bitcoin "multiplier effect."

This means that for every $1 invested, the market cap goes up by $4.

Recently, that dynamic has been on steroids—for every $1 net inflow, Bitcoin’s market cap increases by about $8.30.

This happens because of the limited purchasable supply and more people holding long-term, creating a ton of supply friction.

The Bitcoin ETFs have driven a lot of this, with their capital inflows causing a big jump in the market cap.

If the current pace of ETF investments keeps up ($76 billion so far), Bitcoin could reach $80k-$100k by year-end.

Red Line: This shows the average cost basis over four years for Bitcoin’s market cap.

Blue Line: This shows the "Realized Value," basically how each $1 affects the market cap, typically increasing it by 4x.

Grey Shaded Area: This shows the cost basis, compared to the multiplier effect (the black line), which is currently at an $8.3 increase for each $1 added. I've pointed this out with the red arrow.

Final Thoughts.

The old "it's just supply and demand" line is one you can take to the bank.

I've been chatting with people online lately, and the amount of overthinking around this is unreal.

Keep it simple—we're getting more digital and valuing these assets more, which means their prices will keep going up.

Tyler Winklevoss nails it when he says we should value these networks like social media, not like profit-making companies.

The network of people drives the value, just like with big tech.

Tyler also points out how these tech companies tried to force their tech onto the internet to...

“Give the illusion that it works on the internet. PayPal is a great example, but when you look under the hood, it really does not work on the internet. It is not purpose-built for the internet. Bitcoin was the first internet money in the world. When you realize that, you are like, whoa."

People are just beginning to catch onto what the Winklevoss twins knew about Bitcoin from their social media days.

It's a message worth paying attention to.

Hey man, I liked your newsletter. Are you interested in recommending each other and grow. We are both in the same niche!