Why I've Swapped All My Crypto Into SUI.

The reason almost no one saw coming to amplify asset allocation.

Today’s newsletter is now free for everyone—I want as many people as possible to take advantage of the information and win. That said, paying subscribers truly make this all possible, and their support is what keeps me creating.

Annual members still get a 1-2-1 strategy call and a solid discount, while founding members enjoy private daily access and even more exclusive perks.

If you don’t want to miss out on the deeper insights, now’s the perfect time to upgrade—I’d love to have you on board!

The best life advice I’ve ever heard is this: “You’re either focused on the opportunity or stuck thinking about how the problem is affecting you.”

Right now, the crypto space feels like chaos.

Sideways markets, no clear breakout signals, a strong dollar, and China holding back on printing money have drained the optimism. Crypto prices are feeling the squeeze.

It all breeds opportunity.

In crypto, bad news often sets the stage for the next big move. If you zoom in, you’ll notice the pieces falling into place.

Take bonds, for example. Solid returns are luring money away from riskier assets. Investors are trading their currencies for dollars to snap up U.S. bonds, driving up demand for the dollar. And because U.S. bonds are seen as a safe bet in uncertain times, the dollar keeps getting stronger.

A strong dollar, though, isn’t all good news.

It makes exports less competitive and adds pressure on countries or businesses with dollar-based debt. For crypto, it’s a double whammy—it tightens liquidity, and crypto thrives when financial conditions are loose.

Looking ahead, I believe Trump could aim to weaken the dollar, especially if it gives him leverage in trade deals.

Julien Bittel, a sharp mind in business cycles and crypto, suggests this dollar strength could lead to more rate cuts—not fewer—in 2025. If history repeats itself, we might see Trump attempt a dollar-weaken strategy, just like in 2017.

As Julien Bittel explains:

“Trump understands the impact of a strong dollar – and the same logic applies to high interest rates. They suppress exports, hurt corporate earnings, and slow economic growth. What happened next? Well, the dollar began a significant decline, setting the stage for one of the most pivotal macro moves we've seen in years.

Higher interest rates lead to favourable bond yields (red line), but they also push the dollar higher. A stronger dollar (blue line) then squeezes global liquidity for the reasons already explained.

The takeaway? While the market feels like it’s stalling, the foundations for a shift are quietly building.

We might one day realise this was the moment everyone overlooked.

Diversification doesn’t mean much when everything moves in sync with financial conditions like interest rates and money printing.

At that point, it’s all about choosing the best risk-adjusted asset with the staying power to survive the cycle. For me, that’s been Solana—until recently.

Solana drives 60% of all crypto transactions, and it’s been my highest conviction trade. But late last year, I started swapping my SOL for SUI, which I originally picked up at $0.50.

Now? I’ve gone all in. Every bit of my liquid crypto is in SUI.

I’ve written before about why SUI’s technology is game-changing, especially considering all five co-founders and former Facebook employees have a track record worth paying attention to.

Former product leads for research and development for the Facebook Libra project and now Co-Founder of SUI — Adeniyi Abiodun, says:

“Our Vision for Sui is to build a global coordination layer for intelligent assets, going beyond traditional blockchains. We’re creating a decentralised web stack that supports everything from smart contracts to decentralised storage with Warus, a global storage layer that is more distributed and cost-effective than AWS (cloud storage). This infrastructure will underpin a wide range of applications, offering unprecedented security and decentralisation.”

Right now, it’s less about what the technology can do and more about where people are rotating their money. Crazy, I know.

In crypto, the purest truth of performance is always the price. That’s it.

I’ve compared the best-performing (big-name) assets since the start of this bull run—DOGE, XRP, SOL, and SUI. At the very top of the chart below, SUI is forming a textbook cup-and-handle pattern.

Here’s what that means: when financial conditions improve, attention in the space ramps up. That attention fuels amplified buying, creating a demand surge that supercharges these patterns.

Typically, there’s a brief consolidation or retracement period where traders take profits before the next breakout. If the price breaks above the cup’s rim with strong volume, it signals a bullish continuation—and a likely price surge.

That’s exactly what the SUI chart is showing right now with four breaks to the upside since October 2024.

How to channel out the noise.

A common way to measure crypto value, given they are network adoption models built on financial rails, is by looking at the price.

That part’s straightforward. The next step? Pair those assets against other top-performing ones to create a ratio.

Here’s how it works: compare whether the ratio goes up or down. This gives you a clear sense of which asset might outperform.

When financial conditions improve, retail buyers tend to amplify trends already in motion, making these ratios even more insightful.

For example, let’s say today’s prices are:

ETH/USD: $3,500

BTC/USD: $100,000

To find the ETH/BTC cross rate, divide $3,500 by $100,000. The result is 0.035, meaning 1 ETH is equivalent to 0.035 BTC.

All you are looking to do is see if that ratio goes up or down.

Simple, yet powerful.

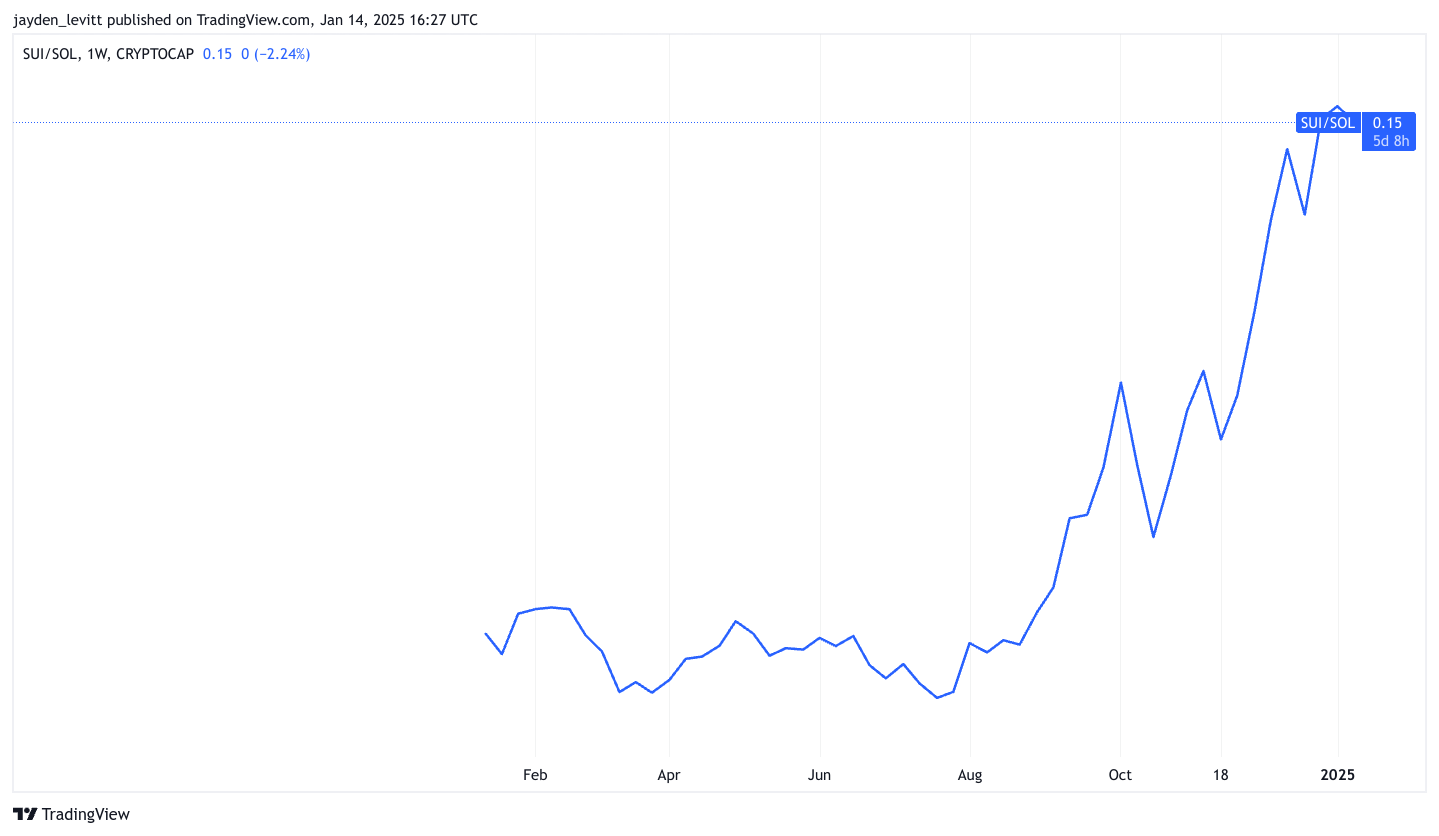

Let’s take a closer look at the top four performing majors this cycle and compare them to SUI, starting with Solana.

SUI is outperforming Solana, showing those textbook cup-and-handle patterns again—and it’s outpacing SOL by 4x. With conditions set to improve, I’m confident this outperformance will continue.

For me, holding onto Solana doesn’t make much sense right now (though I’ll add a caveat in the final thoughts section of this blog).

Next on the purge list is DOGE.

I’ve got a soft spot for this asset—Uncle Elon’s been pumping it to the high heavens, and it’s outperformed Bitcoin by 500% since its launch in 2012. Don’t tell the Maxis that.

But here’s the thing: SUI is still outperforming.

Its ratio against DOGE jumped from 0.09 to 0.27, a 3x multiplier. With SUI’s market cap being 10x smaller, there’s less buy pressure needed for it to rise further.

These are just my personal thoughts—others might see it differently. But for me, the data speaks loudest right now.

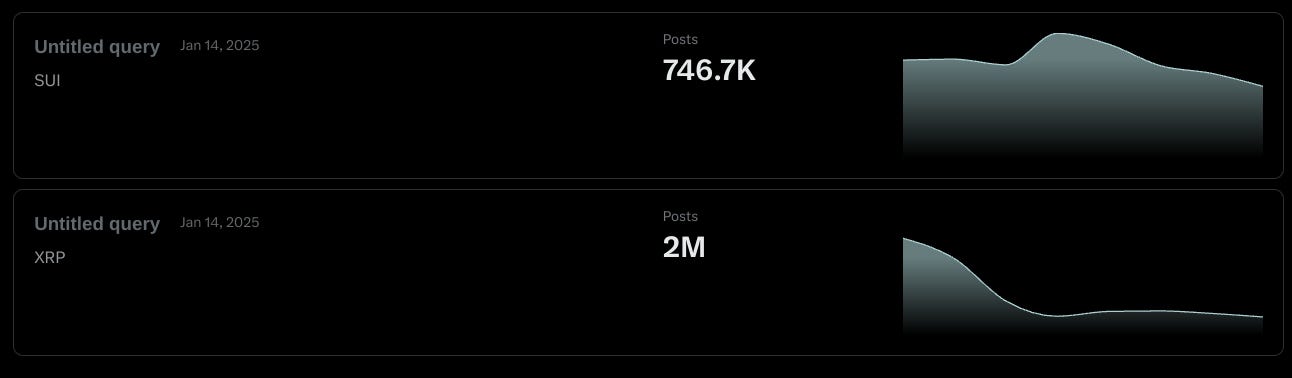

Next up is XRP.

Here’s where things get nuanced.

When XRP went on its parabolic run, I got loads of messages about it. The challenge? Unless you were deep in the community, spotting it was tough—there’s no on-chain activity to track.

With Solana, it was easier.

SOL makes up 60% of the total crypto transaction volume, and I could clearly see SUI breaking out against it. SUI also started outpacing XRP by 3x, jumping from a ratio of 0.09 to 0.26.

Now it’s back down to where it was — SUI and XRP are going toe-toe.

But remember that XRP’s market cap is 10x that of SUI, meaning it’ll take much more buy pressure to see similar % gains. The other consideration is that SUI’s total supply is 10 billion tokens, whereas XRPs are 100 billion.

They are two completely different technologies, and that is just one data point. That said, I believe XRP will continue to do very well.

Here’s the OG: Bitcoin.

People treat BTC like a cult—and honestly, it probably is. But if you’re working with limited capital, your job isn’t to get caught up in the “it’s only BTC” mindset. Instead, you should focus on optimising your capital allocation for the highest risk-adjusted returns.

Meme coins can deliver massive returns, but they’re ridiculously risky.

Take a look below—you’ll see the cup-and-handle pattern again, with SUI breaking out against Bitcoin.

This should be obvious.

Smaller market-cap assets in the top four or five tend to rise faster percentage-wise when money rotates into them. It’s simple maths—you don’t need to be a genius to figure it out.

Final Thoughts.

In a bull market, all these assets are gonna pump. So, for me, spreading my allocation across all of them just feels like watering it down.

If you’re someone holding the top 4 or 5 assets and you’re all about the “set it and forget it” approach, ignore everything I’ve said here—you’ll do just fine. Holding top-tier assets long-term is a solid play.

That said, when it comes to % gains, it’s a two-horse race. And let’s be honest—XRP’s growing mindshare and social media buzz on X are impossible to ignore.

For me, it all boils down to one thing: supply and demand.

I’ve had tons of messages about XRP—it’s clearly performing well.

But I prefer to bet on assets with lower supply and smaller market caps as my high-conviction plays. Even if they underperform slightly, odds are they’ll still deliver solid returns.

For SUI, out of 10 billion tokens, only 3 billion are in circulation.

That kind of supply friction is a significant advantage in a bull market (though it can work against you in a bear market).

In this bull market, everyone’s about to look like a genius.

But here’s the key: stick to the top tokens, set your time horizon, and work backwards with clear selling markers (if you intend to sell at all).

That way, you’re not just chasing prices—the market starts working within your framework.

I’ll dive deeper into that another day.

This is why I’ve moved all my liquid crypto (not including NFTs) into SUI.